How to find your tax references

There are two main references, Accounts Office Reference and Employer PAYE Reference, that are required before anything can be submitted to HMRC.

HMRC uses these references, alongside the Government Gateway credentials to accept the Full Payment Submission (FPS) or Employer Payment Summary (EPS) when it is submitted.

New Employers

If you have just registered as an employer, HMRC would have sent you letters with the references and these references will also be on any future correspondence.

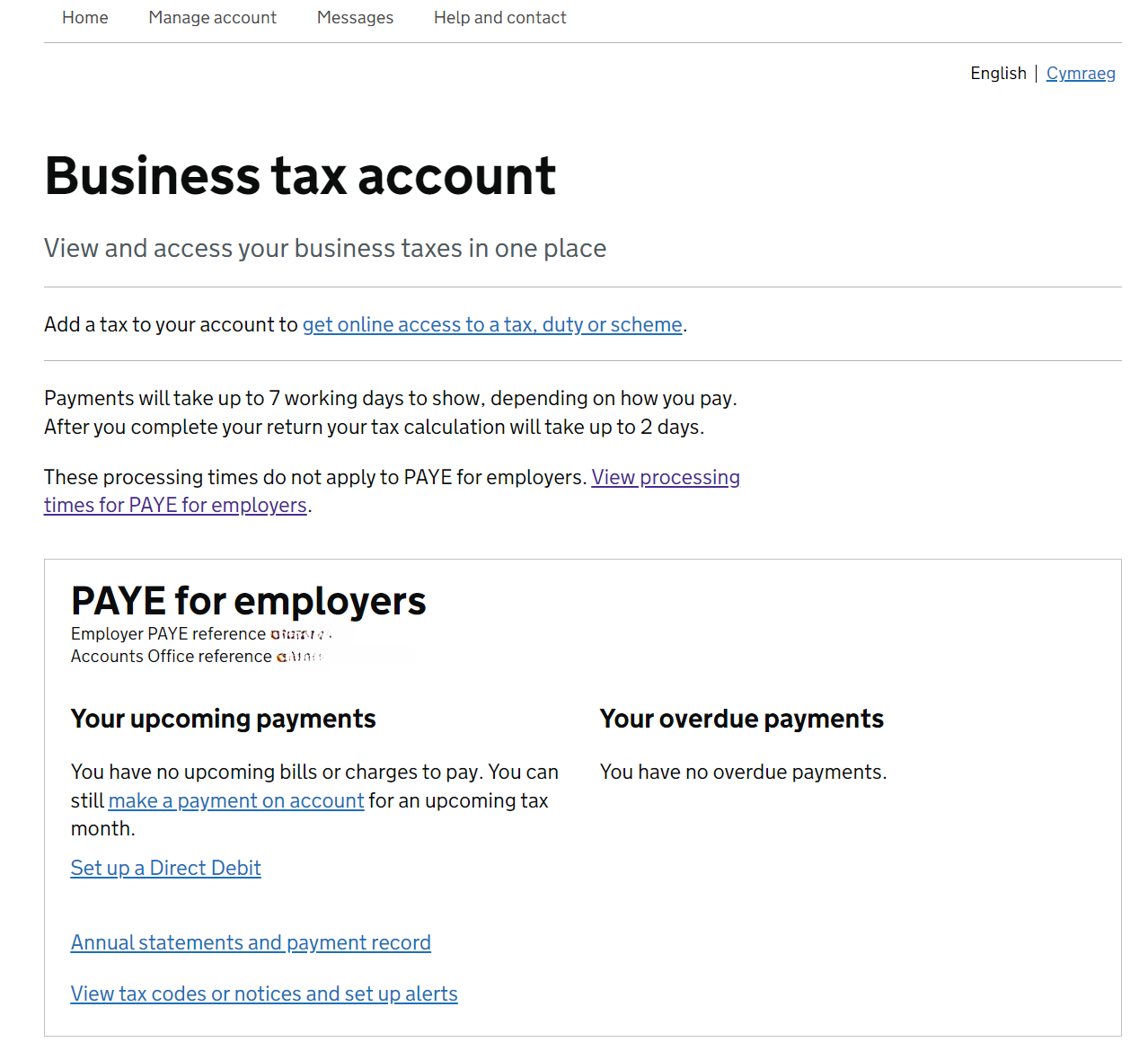

Existing Employers

The references should be in the business government gateway account under PAYE for employers. If you cannot see these details, it could be the PAYE scheme is not linked to the account. Please seek support from the HMRC Employers helpline.

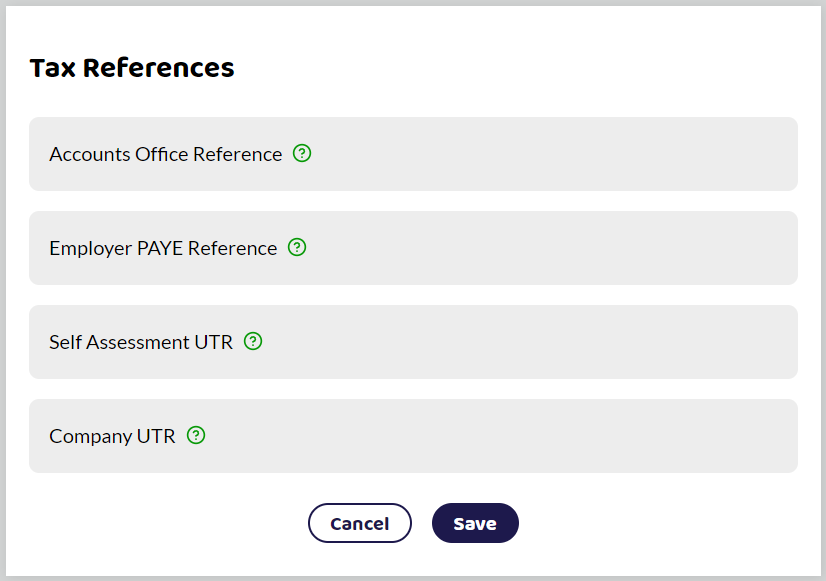

Add the Tax References

Within the Company Setup page edit Tax References.

Accounts Office Reference

This is a unique 13-character code that was issued when you first registered as an employer.

The format should be similar to 123/PA12345678.

Employer PAYE Reference

It should look similar to 123/AA12345. It will always start with the 3 digits of your tax office code followed by a slash. There may be any combination of letters and numbers after the slash but usually will include 2 letters and 5 numbers.

Self Assessment Unique Tax Reference

Your 10-digit Unique Tax Reference (UTR) number. Complete this field if you are paying employees personally or as part of a partnership. You can leave this blank.

Company Unique Tax Reference

Your company’s 10-digit Unique Tax Reference (UTR) number.

Also known as a Corporation Tax Number.

If you are not paying employees as a company you can leave this field blank.

Do not complete both the Self Assessment UTR and the Company UTR.