As an employer, there are several statutory payments that you may need to pay your employees.

Employers can normally reclaim 92% of this but small employers may be eligible to claim back 103%. If you are eligible, you can select this in tax settings. For further guidance on reclaiming statutory payments and to check your eligibility, please see the HMRC guidance Recover Statutory Payments.

What statutory payments can I reclaim?

Statutory Maternity Pay (SMP)

Statutory Paternity Pay (SPP)

Statutory Adoption Pay (SAP)

Follow the links above for individual HMRC guidance. There are calculators available on the HMRC website to enable you to calculate the correct amounts you should pay and what you can reclaim. Some employers can apply to HMRC to pay you in advance if you are unable to make statutory payments. Get financial help with statutory pay.

Statutory Maternity Pay — weekly rate for first 6 weeks | 90% of the employee’s average weekly earnings |

Statutory Maternity Pay — weekly rate for remaining weeks | £172.48 or 90% of the employee’s average weekly earnings, whichever is lower |

Statutory Paternity Pay (SPP ) — weekly rate | £172.48 or 90% of the employee’s average weekly earnings, whichever is lower |

Statutory Adoption Pay (SAP ) — weekly rate for first 6 weeks | 90% of the employee’s average weekly earnings |

Statutory Adoption Pay — weekly rate for remaining weeks | £172.48 or 90% of the employee’s average weekly earnings, whichever is lower |

Statutory Shared Parental Pay (ShPP ) — weekly rate | £172.48 or 90% of the employee’s average weekly earnings, whichever is lower |

Statutory Parental Bereavement Pay (SPBP ) — weekly rate | £172.48 or 90% of the employee’s average weekly earnings, whichever is lower |

SMP, SPP, ShPP, SAP or SPBP proportion of your payments you can recover from HMRC | 92% if your total Class 1 National Insurance (both employee and employer contributions) is above £45,000 for the previous tax year 103% if your total Class 1 National Insurance for the previous tax year is £45,000 or lower |

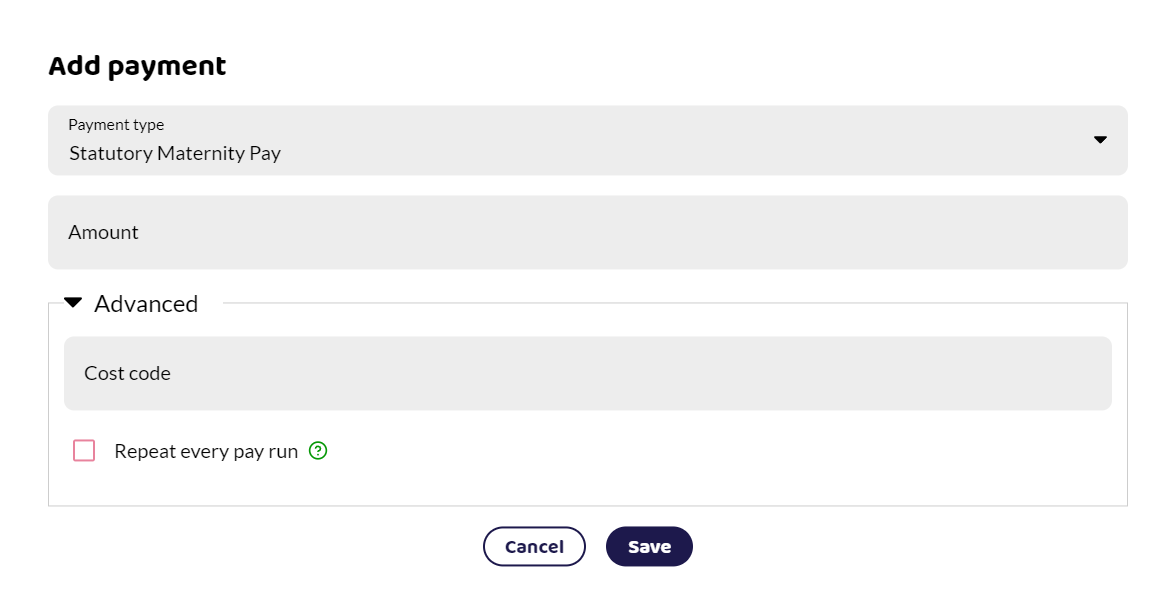

How do I add a statutory payment?

When you add a payment to an employee, you will see in the drop down menu that each statutory payment has its own name. Select which payment you need and enter the amount you are paying. You must use these pay elements if you wish to reclaim from HMRC through the system.

With statutory payments they would be considered normal pay, so would be subject to tax, national insurance and pensions as any other normal payments would be.

How can I claim this back in Shape Payroll?

When you have entered the above payments to your employees, you complete the pay run and submit your FPS. An EPS - Employer Payment Summary will also be produced, which can then be submitted. You will find this in your RTI Submissions list. See our guide RTI Submissions.

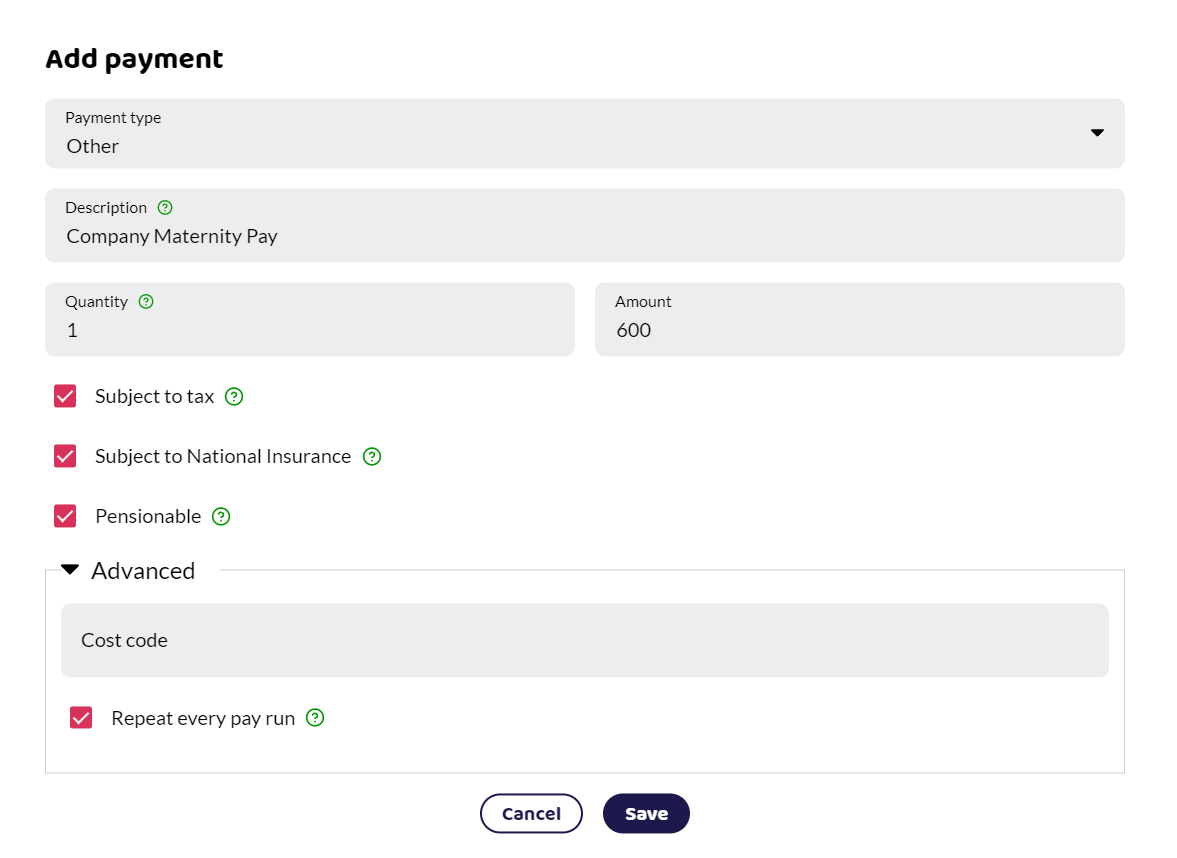

How do I enter a payment above Statutory?

You can only claim back statutory and anything above this must be made as a separate payment. It will be subject to tax, NI and any pension deductions. You can select Other from the drop down menu in payments and change the description to suit your payment type.

I got an advance, do I still need to claim it?

You must still submit an EPS to HMRC for every statutory payment so that they know what has been paid and what needs to be offset against any PAYE that you owe. You will need to check your PAYE account in your government gateway to make sure you are paying the correct amount of PAYE each month as Shape Payroll does not record advance statutory payments from HMRC.

What about Statutory Sick Pay?

Unfortunately, employers cannot reclaim Statutory Sick Pay (SSP) but have an obligation to pay it. For further guidance on working out how much SSP you need to pay, please follow the guidance here: You can record SSP payments you have made by selecting SSP from the drop down menu in payments.

But I heard I can reclaim some statutory sick pay?

The government did announce employers with less than 250 employees could reclaim 2 weeks of Covid-19 related SSP per employee. This has now ended and no can longer be claimed. Waiting days for SSP now applies to covid related sickness.

Migrating payroll software during a tax year

If you are moving to Shape, make sure that you add any statutory payments that have already been claimed within the tax year into the opening figures.

Claiming statutory payments from a previous year

If you have been told by HMRC to reclaim a statutory payment from a previous tax year, you can this payment to the opening figures for the current tax year.

HMRC Further Guidance

Claim back Statutory Sick Pay (Covid-19)

Statutory Maternity Pay (SMP)

Statutory Paternity Pay (SPP)

Statutory Adoption Pay (SAP)