You need to find all the information about your People's Pension scheme before you add it to Shape. Log into your People's Pension Account where you should be able to access the information needed.

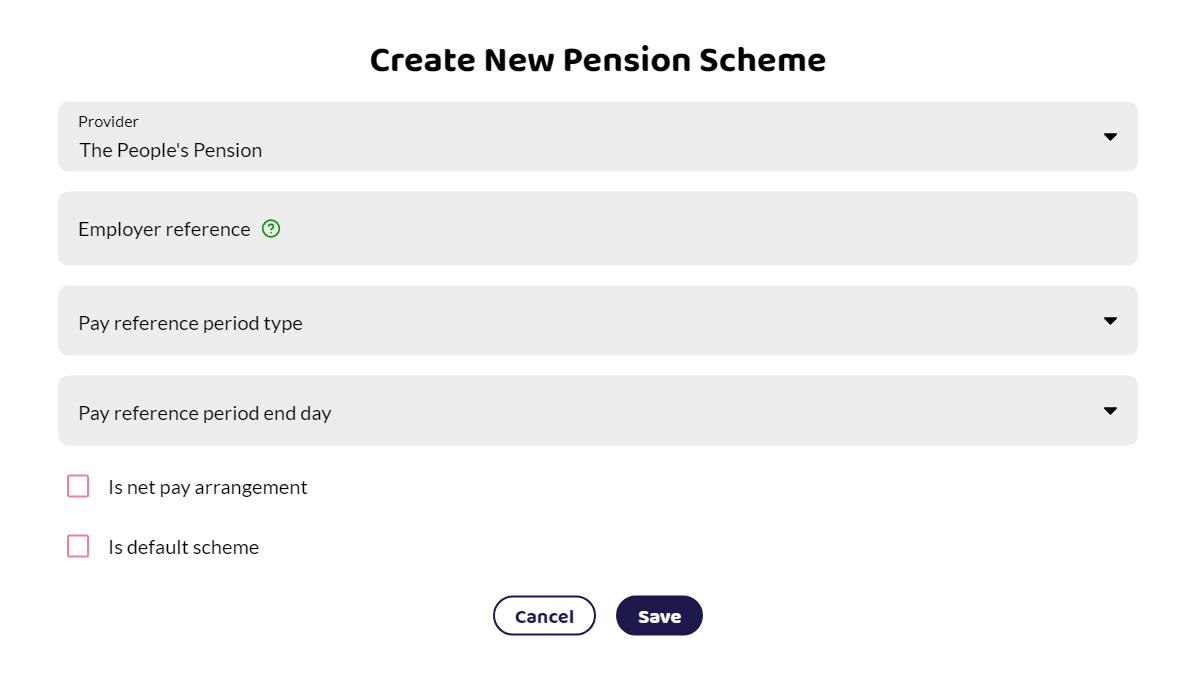

Provider and Pension settings

Employer reference - This is the Admin Account Number. This can be found in your People's Pension account and is normally 5 or 6 digits. If more than one scheme is set up (for example different pay frequencies), there might be more than one Admin Account Number.

Pay reference period type - this is tax periods of calendar periods. A tax period is the 6th to the 5th of the following month.

Pay reference period end day - Monday to Sunday.

The People's Pension is a Relief at source pension by default (referred to as Net tax basis by The People's Pension) but employers can set it up as a net pay arrangement (referred to as Gross tax basis). If you have set up the scheme to be a net pay arrangement scheme, you need to tick the box Is net pay arrangement. Read our article on the differences between relief at source and net pay if you are unsure what your scheme is.

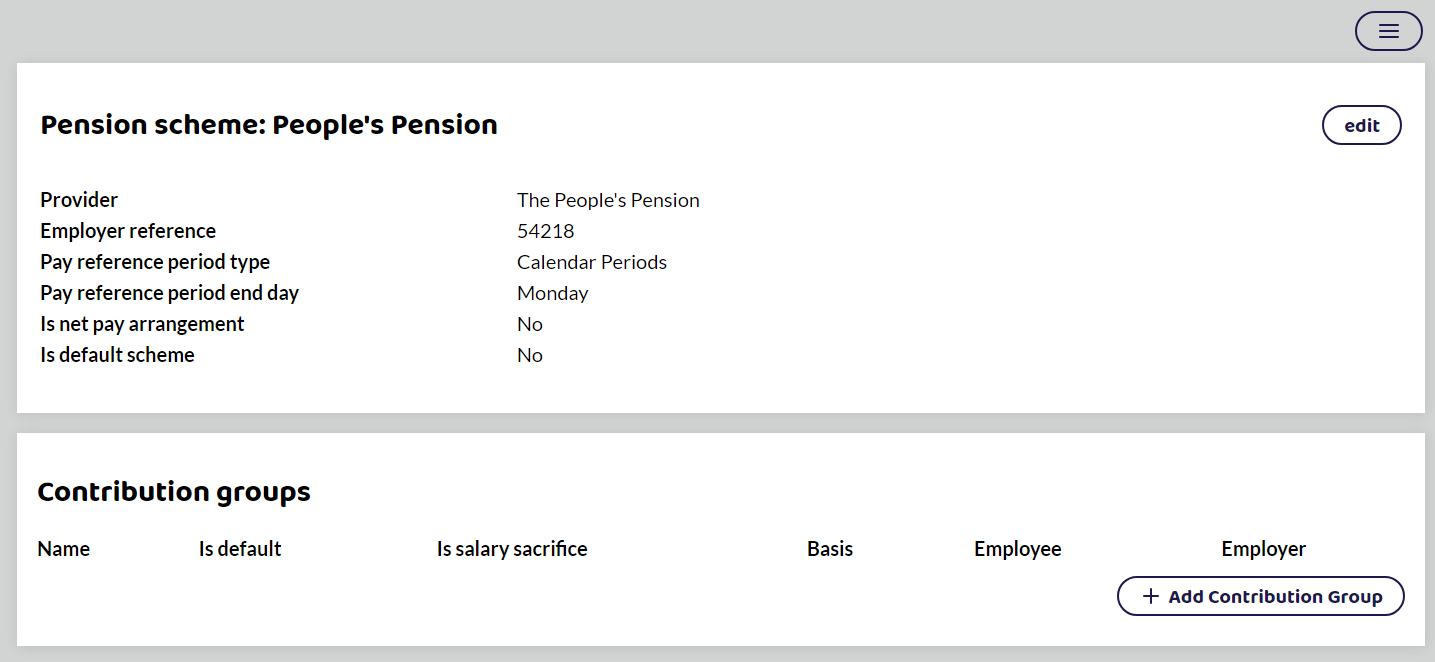

Add a Contribution Group

Select the +Add Contribution Group and you can now set up the amounts for the employer and employee.

Name - This is your personal reference in Shape that might make it easier to identify the scheme if there are lots of schemes.

Reference - This is the AE Worker Group the employees in this group belong to. It could be that different groups will have different groups due to different pay frequencies or contribution amounts. Each group will need an individual scheme set up.

Is it a salary sacrifice scheme?

Earnings basis - qualifying or pensionable.

Contribution type - Fixed or percent.

Contributions - How much the employee and employer are contributing? There are default amounts but these can be changed if the scheme has been set up so that the employer is contributing more.

The People's Pension is a Relief at source pension scheme by default but employers can choose the scheme to set the scheme up as a net pay arrangement. Tick the box if the scheme is a net pay arrangement.

Upload CSV to The People's Pension

On the pension tab within each pay run, there will be a Download Contribution File. This can then be uploaded into The People's Pension, saving you time.

Do not open the CSV, especially if you have excel on your computer as this could change the formatting of the file and cause the file to be rejected when you upload it into Smart Pension.

If you do open the file in excel, do not save the file. If you do, excel may change the date format to DD/MM/YYYY. Any dates in the file need to be changed to show YYYY-MM-DD.

The People's Pension has a guide on manually entering employee data.

The People's Pension Further Guidance

What employers need to know about auto-enrolment tax relief- What is tax relief for relief at source and net pay arrangements?

Salary sacrifice pensions - How do the People's Pension manage salary sacrifice?

Resource Library - Various documents and links to support managing the pension scheme.