What is a Salary Sacrifice?

A salary sacrifice arrangement is an agreement to reduce an employee’s entitlement to cash pay, usually in return for a non-cash benefit.

How does this work with a pension?

An employer may offer the employee an option to sacrifice some of their salary into a workplace pension scheme. The contribution is then made to the pension company as if the employer is making the full contribution.

Add a Salary Sacrifice Pension

First gather the pension scheme details. See Setting up a Pension scheme for the type of information you would need and setting your pension behaviour Shape.

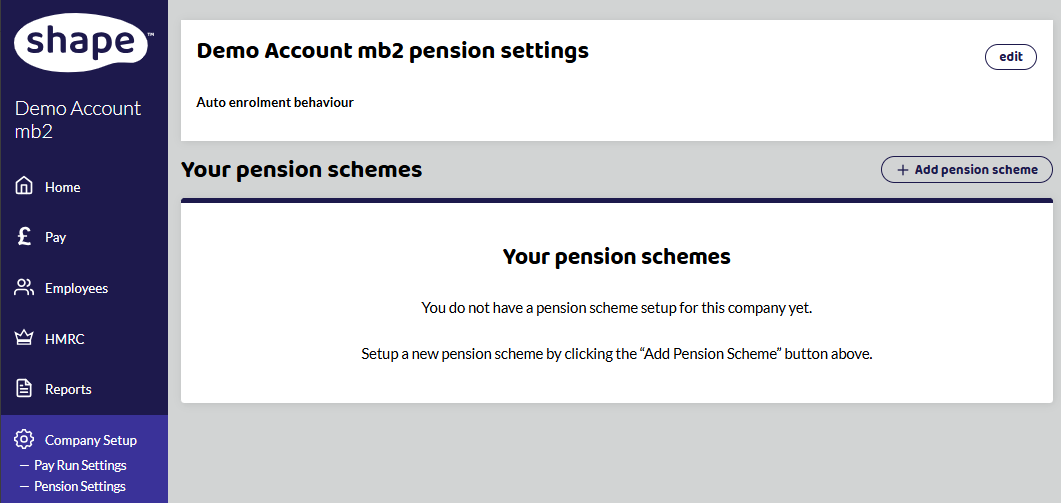

Go to Company Setup - Pension Settings.

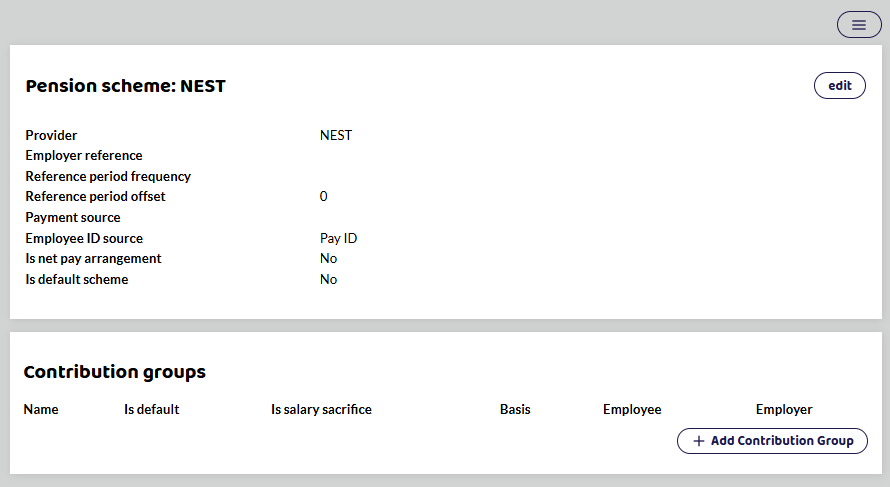

+ Add the Pension Scheme

+ Add Contribution Group

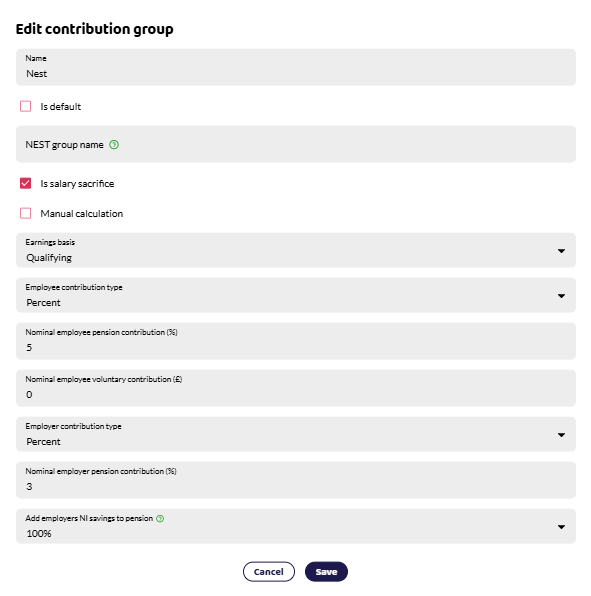

Tick the box to confirm the scheme Is Salary Sacrifice.

Add the amount that the employee and employer is putting into the scheme. This could be based on:

Pensionable or qualifying earnings,

A percentage of earnings or a fixed amount.

The employee can also put in a fixed Voluntary Contribution. If you have employees with different voluntary contributions, you will need to add them as a separate group rather than the default group.

Employers NI Savings

When an employee chooses a salary sacrifice pension scheme, this will reduce the employers national insurance contribution. Some employers choose to add the employers NI savings to the pension contributions. If the scheme operates like this, select the % to Add employers NI savings to pension.

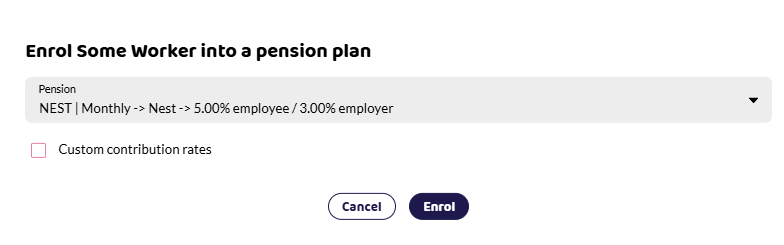

Enrolling an Employee

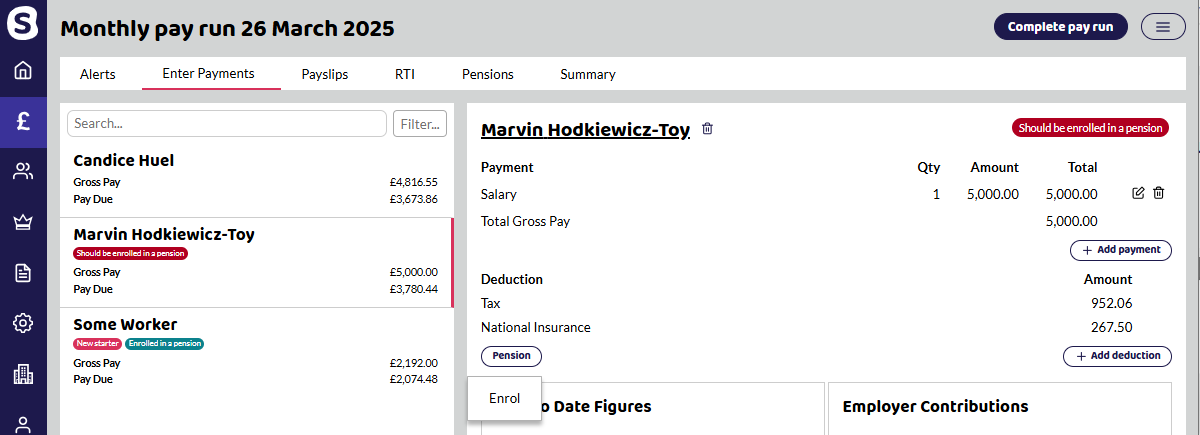

Once the scheme has been set up, you can enrol your employee. Go to the current pay run. Click on the employee and select the Pension button under Deductions. You will get the option to Enrol.

As long as the pension scheme has been set up with the same pay frequency as the employee, you will get the option to add the employee to the scheme.

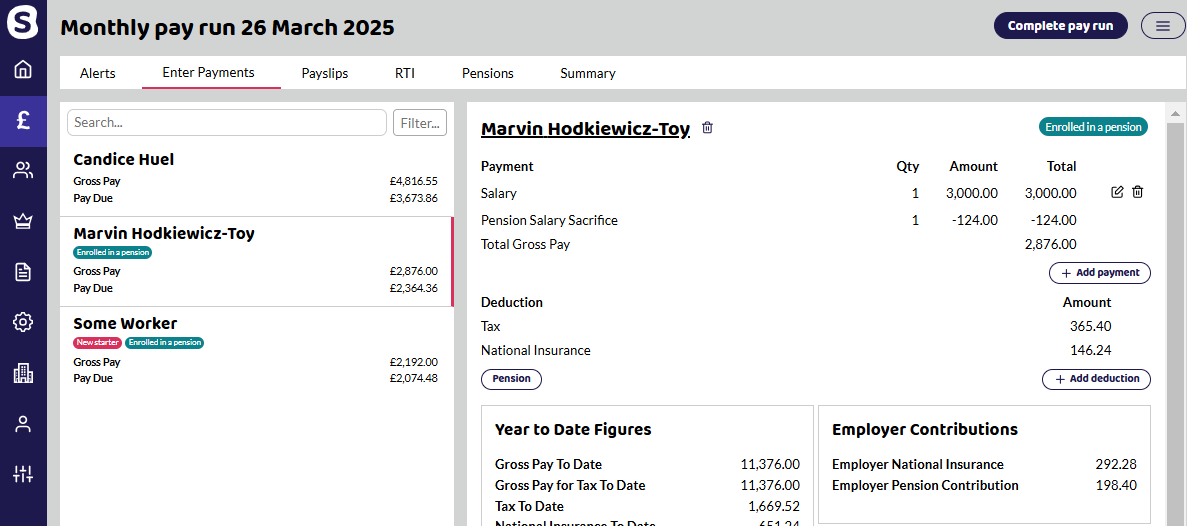

Percentage Amount Salary Sacrifice

If the scheme has been set up as a percentage amount, then all payments that are marked as pensionable will be included.

Below you can see that the employee is contributing 5% of their qualifying earnings. This means for a monthly employee on £3,000 the contribution would be £124.00.

This is £3,000 - £520 (monthly threshold) = £2480 x 5% contribution = £124.00

The employees gross pay for tax has been reduced to £2,876 and the employees 5% 'contribution' has been added to the employer pension contribution.

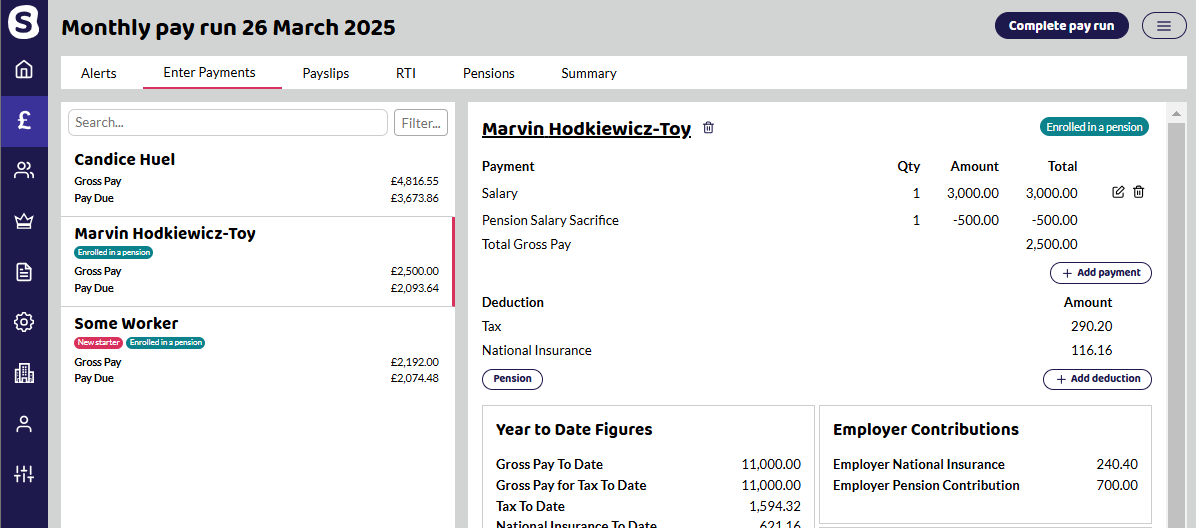

Fixed Amount Salary Sacrifice

If the scheme has been set up as a fixed amount, then this will be the amount deducted every pay period.

Here the employee is sacrificing £500 each month into the pension scheme and the employer is contributing £200. All contributions are then included in the employer pension contribution and the employees gross pay has been reduced.

If using salary sacrifice method, make sure that the contributions are still meeting the minimum for auto enrolment and that the contributions are not reducing the employees pay below national minimum wage. See HMRC further guidance below.