If you do not pay any employees for a full tax month, that is the 6th of one month until the 5th of the following month, you need to notify HMRC to avoid them raising estimated charges against your PAYE account.

You have the option to send a No Payment EPS once a tax period is over or you can send a Period of Inactivity EPS to tell HMRC that you won't be paying employees for future months.

Create a Period of Inactivity EPS for a future month

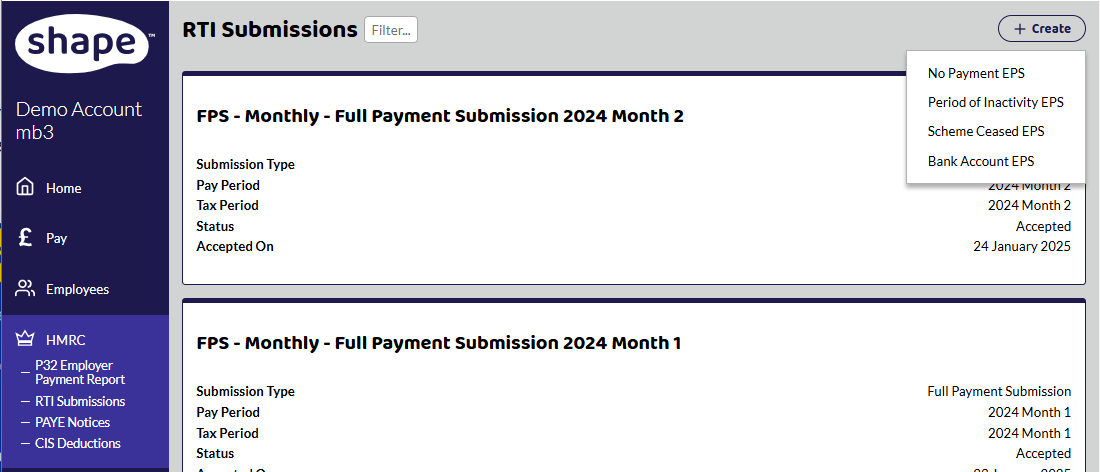

To do this in Shape navigate to HMRC -> RTI Submissions and then select ‘Period of Inactivity EPS’ from the +Create drop down menu in the top right of the list.

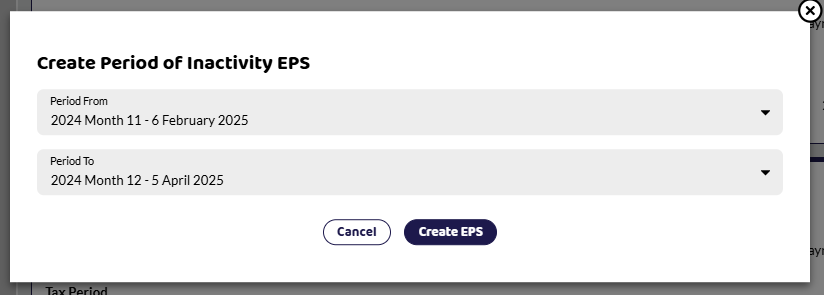

Select the date range you need to report for from the 2 select boxes and then click Create EPS.

Shape will check you have not made any payments in this date range, and if you have it will prevent you from creating the Period of Inactivity EPS.

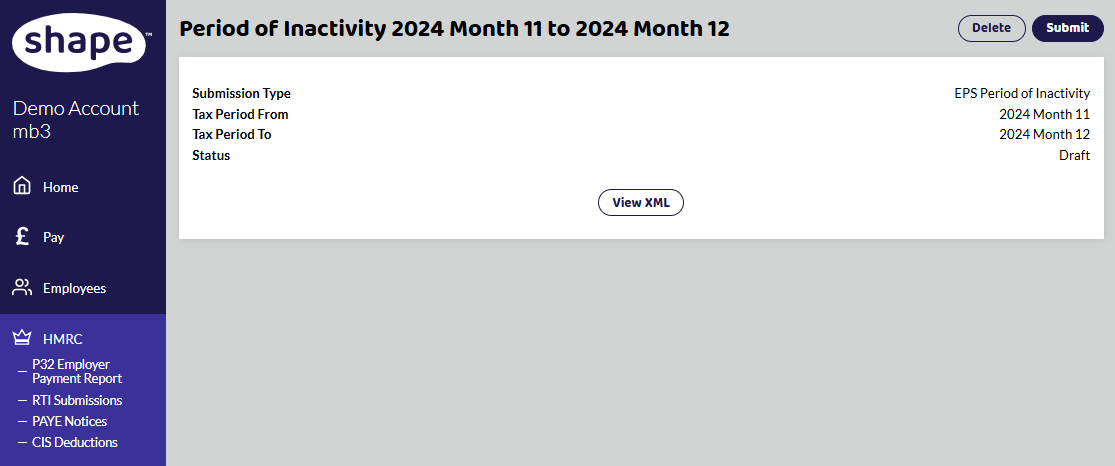

Your EPS is created, and the system will take you to the EPS, where you can double check the details and submit.

Create a Period of Inactivity EPS for several months

You can also send more than one month in advance up until the end of the tax year if you need to.

See HMRC guidance below if you temporarily stop paying employees.