What are pensionable earnings?

Pensionable earnings (sometimes referred to as pensionable salary) is the employees gross earnings used to calculate their pension contributions and may include:

salary

overtime

bonuses

commission

statutory payments like maternity, paternity, adoption and sick pay

holiday pay

Some pension schemes are set up to base pension contributions on all pensionable earnings or only some earnings like salary, overtime, statutory and holiday but ignore bonuses or commission.

Some pension schemes can include all pensionable earnings but also only use qualifying earnings to base the pension contributions on.

What are qualifying earnings?

Qualifying earnings are the name given to the band of annual earnings between £6,240 and £50,270. This has stayed the same for the tax year 2024-2025 as it was for 2023-2024.

If an employer sets up a scheme that uses qualifying earnings only, then all contributions are made on earnings over £6,240 (£520 per month/£192 per week) and up to £50,270.

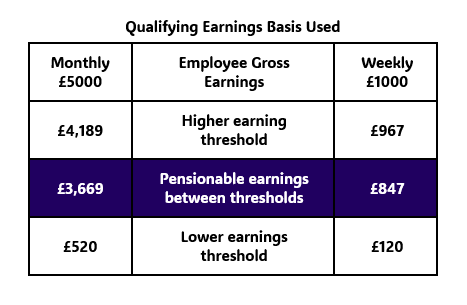

Qualifying Earnings Basis

In the above example, if an employee is paid £1000 a week, the lower earnings threshold of £120 is deducted and any earnings above £967 are ignored. This means the employees pensionable earnings are £847 and is what the pension contributions are based on.

If an employee earns below the higher earning threshold, then only the lower earnings threshold is ignored. As an example, if the employee was paid £800 a week, their pensionable earnings would be £680.

Pensionable Earnings Basis

If an employer uses the pensionable earnings basis, then the lower and upper earnings thresholds don't apply. All gross earnings that are included for the purposes of the pension scheme are what the contribution is based on. Some pension schemes will only be based on salary or wages and won't include variable pay such as bonuses, commission and overtime.

Total earnings basis (also referred to as pensionable earnings)

This is when every pay element must be used to work out the pension contributions.

What earnings basis does my pension scheme use?

Pension schemes can be set up in different ways and can even have slightly different wording to explain their schemes. You must check exactly how your scheme is set up to make sure you are using the right earnings basis and making the correct contributions.

NEST - can be set up with pensionable or qualifying earnings but they ask for the pensionable earnings when adding contributions. Many employers use the qualifying earnings and so you would need to remove the lower earnings and upper earnings and only input the remaining amount. If you go into NEST and view manage group - you will see what earnings basis has been chosen.

Smart Pensions - Uses the terms Unbanded or gross qualifying earnings(pensionable earnings) and Banded (qualifying earnings). They may also have other settings that can apply.

Other pension providers - may use similar terms. Make sure you refer to the pension scheme to understand what contributions need to be made.

Further guidance

If you are still unsure about your pension scheme settings you should check with your pension provider. If you need to set one up, you should consult a pension advisor. The pensions regulator has lots of information that will also support you.

Pension Regulator - Employers

Smart Pensions - Pensionable earnings

The People's Pension - What are pensionable earnings?