Shape Payroll can download your tax code, student loan notices and National insurance number changes from HMRC and apply them directly to your employee records.

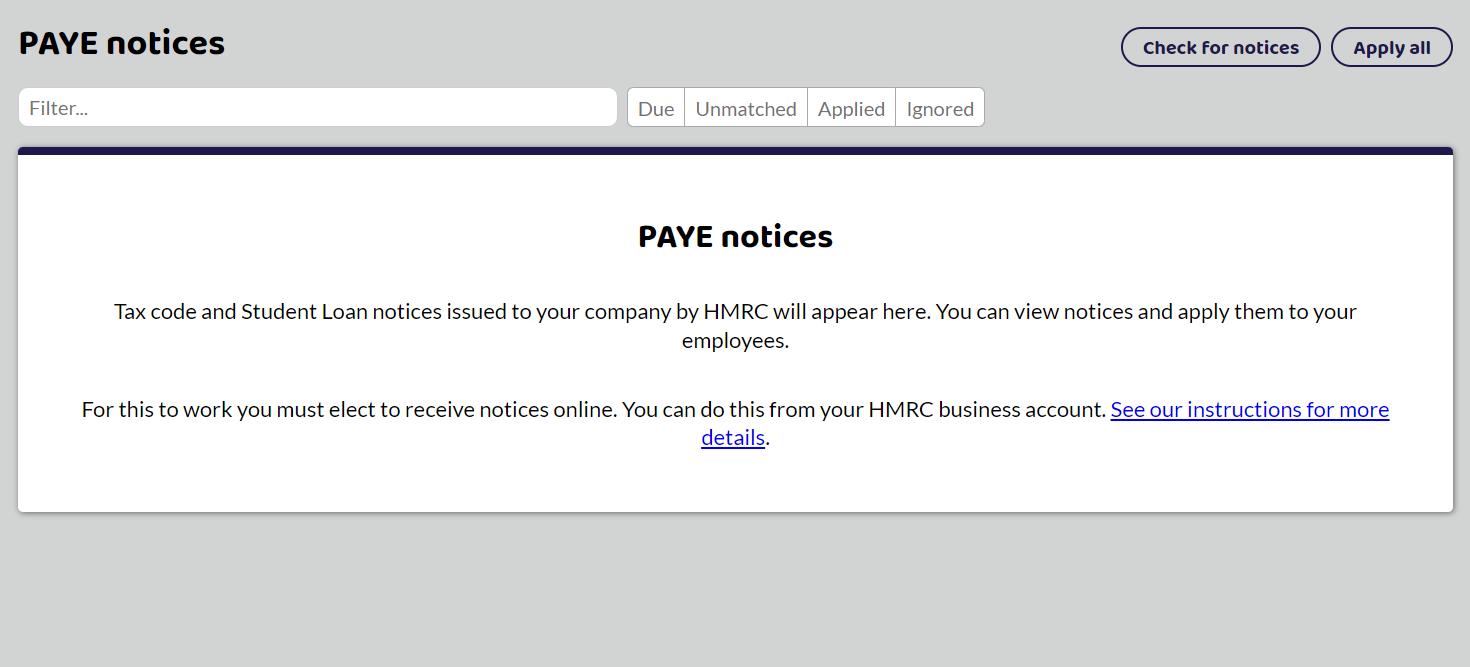

If have the free plan, your HMRC PAYE Notices page will look like this:

If you currently receive PAYE notices by post

To use check notices within Shape Payroll, you must elect to receive these notices electronically. You will need to do this using HMRC’s site. Follow the steps below to set this preference.

Log into your HMRC business account.

Access your PAYE messages by clicking the Messages link in the header and then PAYE for employers messages on the next screen.

You should see a Notices preferences section on the right of the page. Select 'Change how you get tax code and student loan notices'.

Select Yes for all notice types that you want to receive online and click Next. If all the options already say Yes then no changes are necessary.

You should see a summary of your changes.

Confirm you have happy by clicking Submit.

Shape Payroll will only see notices that are issued after you have made these changes.

Please note, if you are an agent, the procedure for setting this up is different. You will need to refer to PAYE for Agents: HMRC Online Services.

If you receive PAYE notices electronically

If you already receive your PAYE notices electronically, you will be able to Check for Notices. You can view and apply notices from the ‘Notices’ option in the HMRC menu.

Check for Notices

When you first check for notices, you may find that you receive a number of notices dating back to when you first set up your PAYE scheme. You can ignore any that are no longer relevant by selecting the notice and choosing Ignore. If there are notices that are relevant, for example new tax codes for this year, select Apply and the notice will update your employees' details.