Setup

First register your employee via the Employees page.

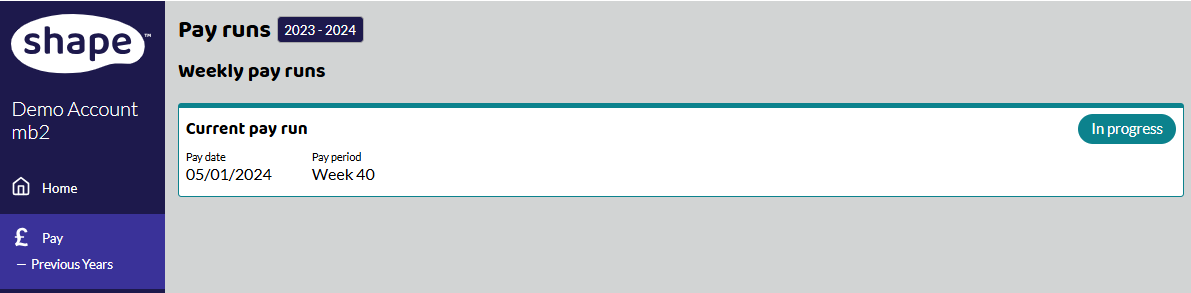

Next head over to the Pay tab, your current in progress pay run should be at the top of the page. Click on it and the payment page for that pay period will open.

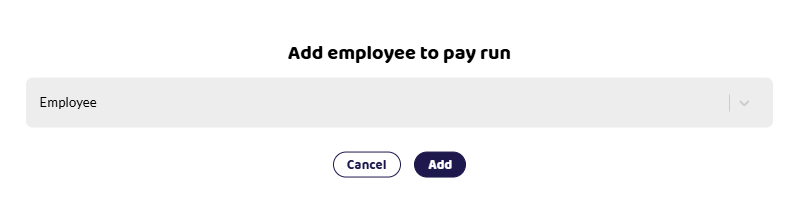

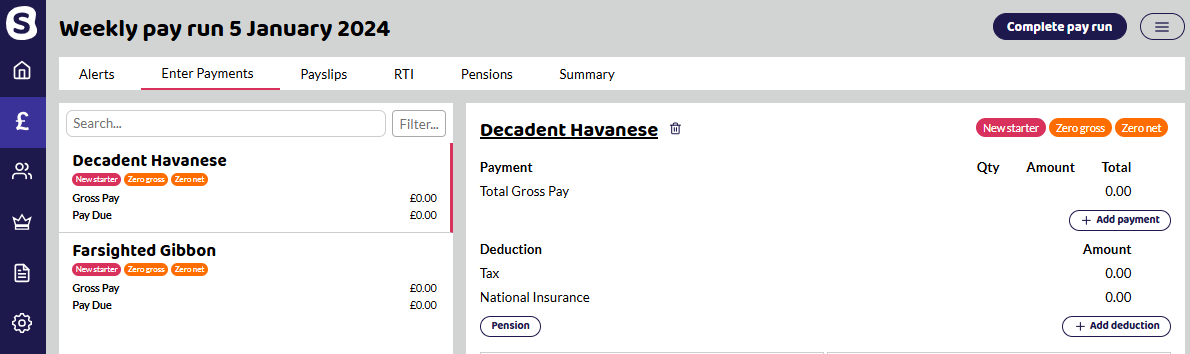

You should see a list of employees you have already paid on the left-hand side. If you have not paid anyone yet this will be empty. Add your new employee by clicking the ‘Add Employee’ button on the right. You can start to type your employee's name to find them or just click the down arrow on the employee box to select them from a list of eligible employees.

For an employee to be eligible to be paid in a pay run they must have a tax code and their start date must be on or before the payment date for the pay run. You can go back to the employee page and edit your employee if you have made a mistake.

Click Add to add the employee.

Pension

You may need to add your employee to a pension plan at this stage. Click the Pension button under the Deduction section and select Enrol. The pension needs to be set up before you can add them. Use an effective date before the pay run date and select the pension from the drop-down list.

Payments

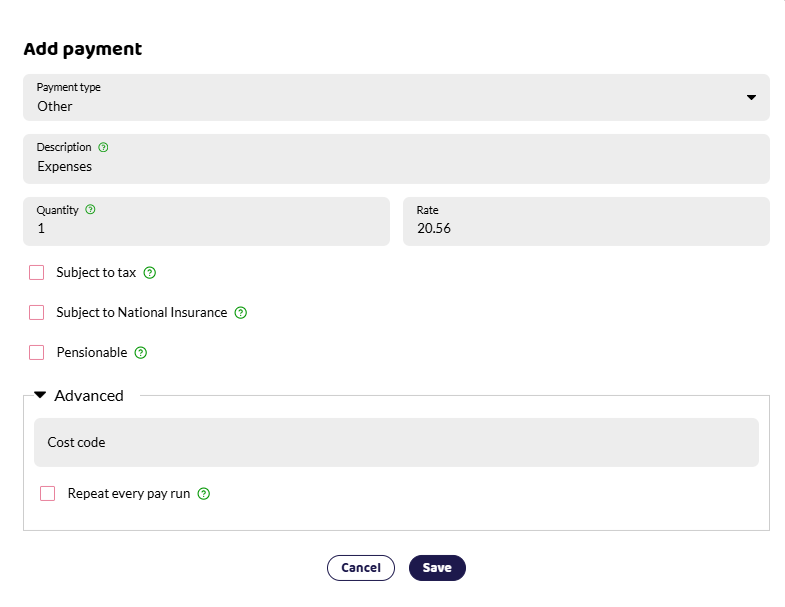

You can now add the payments and deductions you need to make to the employee. Use the + Add Payment button on the right to open the Add Payment dialogue.

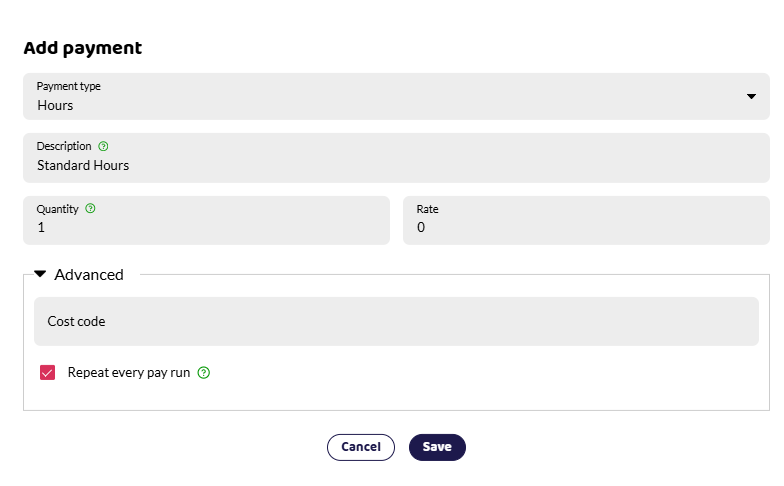

Select the payment type you want, for example, ‘Hours’, change the description if you don’t like the default and add in the amounts. If this payment should be made every month, e.g. Salary then the ‘REpeat every pay run’ box should be ticked. If this is a one off payment e.g. Bonus then do not tick this box.

If you select one of the Statutory Payment types then the figures will be used when calculating your HMRC payments and when submitting the Full Payment Submission (FPS) and Employer Payment Summary (EPS) to HMRC. It is important to select the correct statutory payment type or you may not be able to claim relief against your NI bill for those payments. Please note, Shape can help you calculate Statutory payments by using the Absence tab on the employee's record.

All named payment types are subject to Tax, NICs and Pensionable. If you need to make another type of payment, e.g. an expense reimbursement or a mileage claim then select the Other payment type. You can then select if the payment will be taxed, NICed or included in pension calculations. Please refer to HMRC guidelines below for the type of payment you are making.

The amount of tax, NICs and pension will be calculated automatically when you save a payment or deduction.

Deductions

If you need to add additional deductions you can do this from the +Add Deduction button.

Select a Deduction from Net if the employee should pay tax before the deduction is made, e.g. for a Deduction of Earnings Order.

Select Deduction from Gross if tax should not be charged e.g. to cover a shortfall in a till. If you need to do something else select the ‘Other’ option and check the boxes as appropriate.

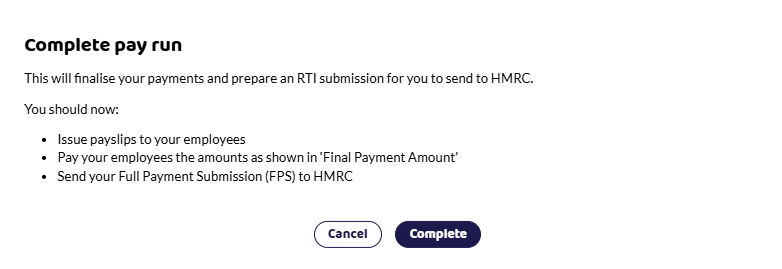

Complete Pay Run

Once you have put all payments and deductions through for all employees, you then need to press the Complete Pay Run button at the top of the screen and you will get the following message:

When you complete, the Enter Payments will be marked with a tick sign and you move on to the next tabs.

You need to send payslips to your employees, submit your FPS and send any payments to your employees, HMRC and pension provider. Follow the links below for more information on these steps.

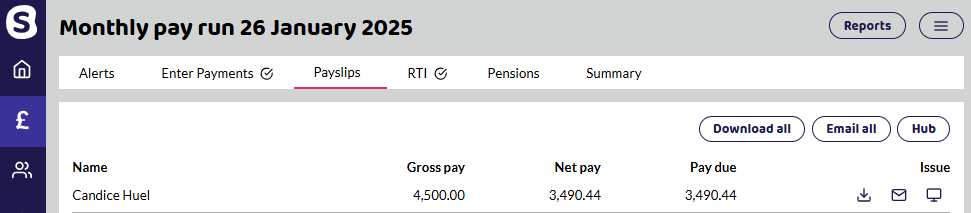

Payslips - download or email employees.

Full Payment Submission (FPS) - Send your RTI to HMRC.

Reports - download different reports with pay details and pension information.

P32 - Review how much is owed to HMRC.