If you do not pay any employees for a full tax month, that is the 6th of one month until the 5th of the following month, you need to notify HMRC to avoid estimated charges against raised your PAYE account.

You can do this by creating a No Payment EPS or a “no payment to any employees report”.

You must send a No Payment EPS between the 6th and the 19th of the following tax month or HMRC will send you a notice estimating how much you owe.

Create a No Payment EPS for one month

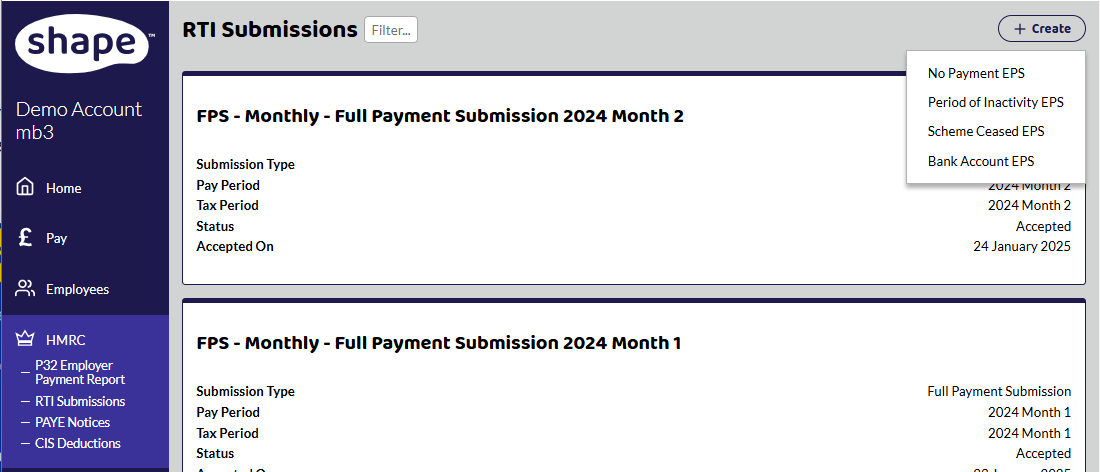

To do this in Shape Payroll navigate to HMRC -> RTI Submissions and then select ‘No Payment EPS’ from the ‘Create’ drop down menu in the top right of the list.

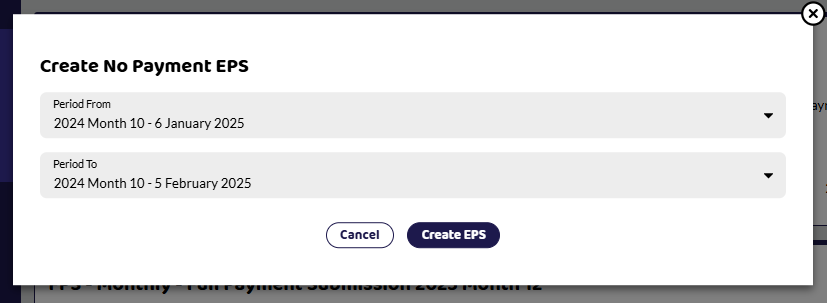

Select the date range you need to report for from the 2 select boxes and then click Save.

Shape Payroll will check you have not made any payments in this date range, and if you have it will prevent you from creating the No Payment EPS.

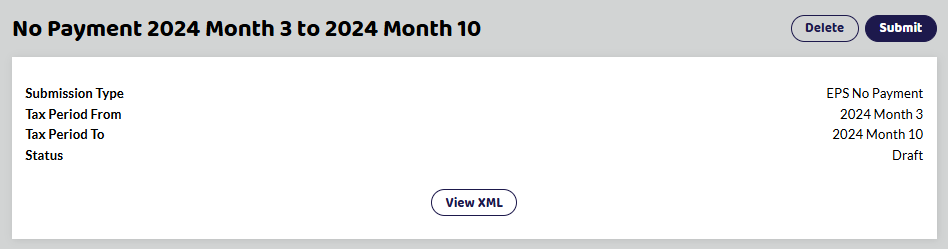

Your EPS is created, and the system will then navigate to the EPS page where you can double check the details.

Create a No Payment EPS for several months

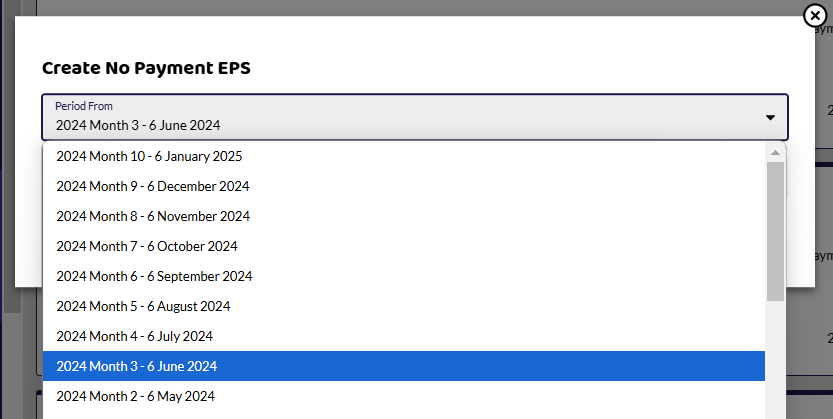

You may not have paid employees for several months in the past and haven't told HMRC - for example, you only pay seasonal employees. You can create a No Payment EPS for several months in one submission.

See HMRC guidance below if you temporarily stop paying employees.

The above No Payment EPS will tell HMRC that no employees were paid from Month 2 to Month 7.

Tell HMRC that in the future you won't pay anyone

If you need to tell HMRC that you won't pay anyone in the future, you will need to send a 'Period of Inactivity EPS'. This can be found under RTI Submissions as above.