What is a starter checklist?

HMRC provide a starter checklist which gathers all the required information from an employee so that their details can be entered into the payroll software.

There are a few reasons why the HMRC Starter Checklist should be used:

A new starter does not have a P45

A new starter has a P45 but it was from a previous tax year

A new starter does have a P45, but the information on it has changed, such as address or name

A new starter has a student or postgraduate loan. The P45 does not show which type of student loan the employee has.

The form can be completed online or a printed copy can be given to the employee.

UK employees

Starter checklist for employees (PDF, 328 KB, 3 pages), if you normally live and work in the UK

Seconded employees

If an employee has been seconded to work in the UK, then there is a different starter checklist for the employee to complete.

Starter checklist for employees seconded to work in the UK by an overseas employer (PDF, 280 KB, 3 pages)

How to use the Starter Checklist

Once the new starter has completed the form, you can add the employee to the Starter Wizard in Shape.

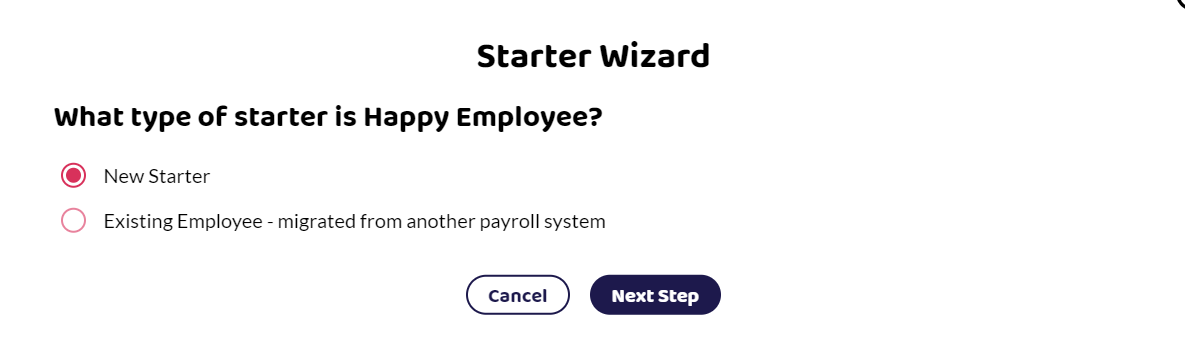

When you have entered the personal details into Shape for the employee, you will be asked what type of starter is the employee?

Select that the employee is a new starter.

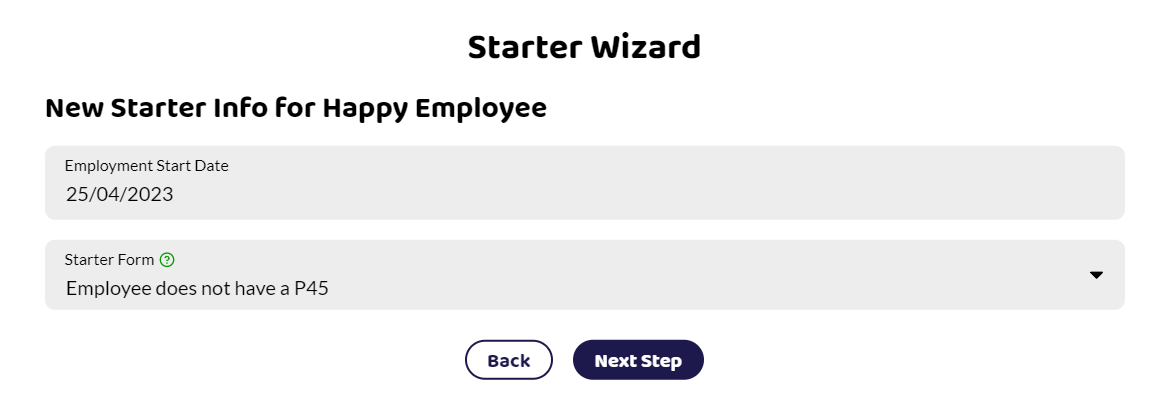

Select that the employee does not have a P45. This is because you are using the starter checklist.

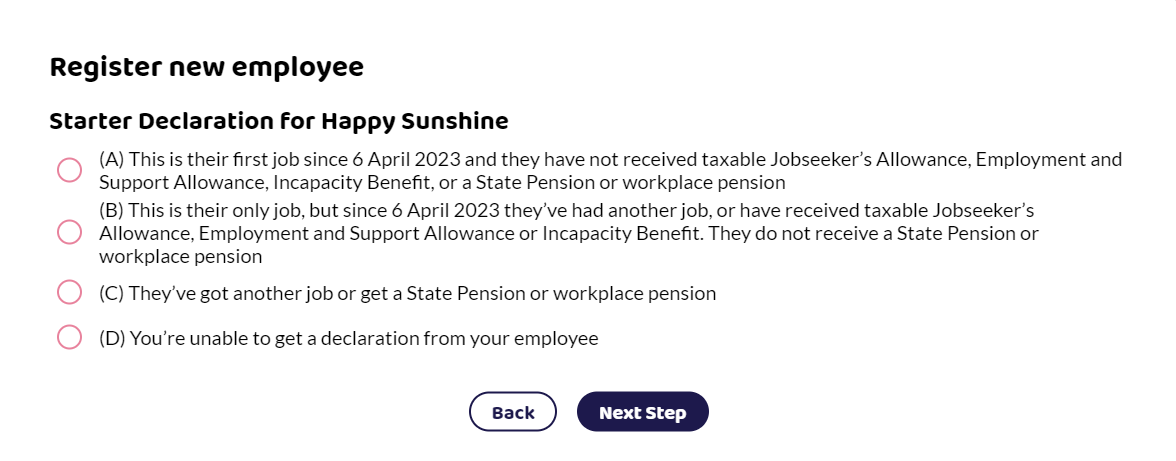

The questions on the starter declaration in Shape are the same as the statements on the starter checklist form:

Statement A This is their first job since 6 April 2023 and they have not received taxable Jobseeker’s Allowance, Employment and Support Allowance, Incapacity Benefit, or a State Pension or workplace pension

Statement B This is their only job, but since 6 April 2023 they’ve had another job, or have received taxable Jobseeker’s Allowance, Employment and Support Allowance or Incapacity Benefit. They do not receive a State Pension or workplace pension

Statement C They’ve got another job or get a State Pension or workplace pension

Tax codes

Depending on which statement the new starter has picked, this will determine the tax code that is applied. Shape will add the correct tax code to the employees details for you.

The following tax codes will be applied:

Statement A - 1257L

Statement B - 1257L W1/M1

Statement C - BR

To find out more about tax codes and how they are applied, read our help article on A guide to Tax codes.

Once the first submission to HMRC has been made with the new employees details, if HMRC has calculated a different personal allowance for the employee, you will receive a HMRC notice from them with the new tax code.

Do not send the checklist to HMRC