When migrating payroll software, make sure you gather the following information for each employee:

Employee details, including current address and bank details.

RTI ID (sometimes referred to as payroll ID)

Current tax details like tax code or student loan.

If they have been paid in the tax year, you need the employee's year-to-date figures.

Adding the employee

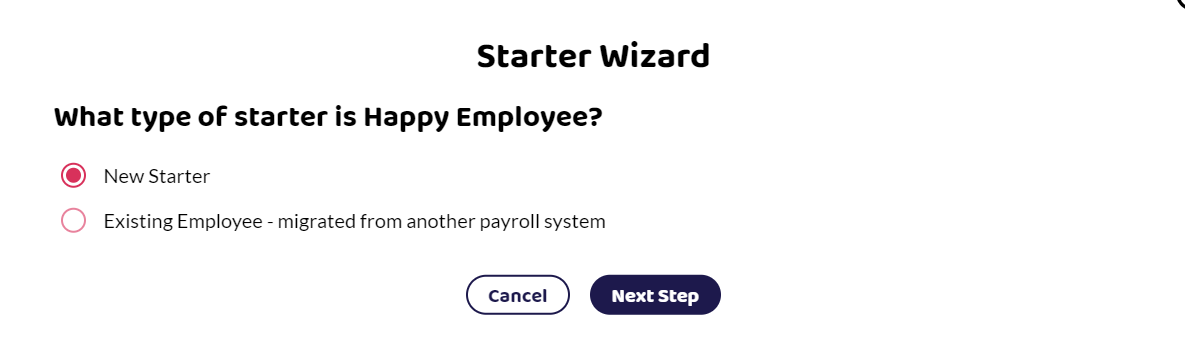

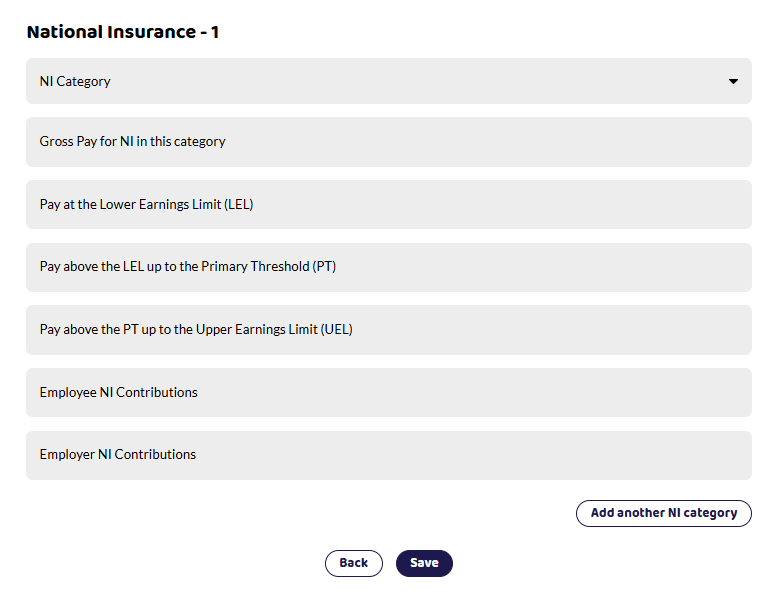

If you are migrating from another payroll system or managed payroll, you need to make sure you select Existing Employee - migrated from another payroll system when adding the employee to the starter wizard so that you can set up the following details:

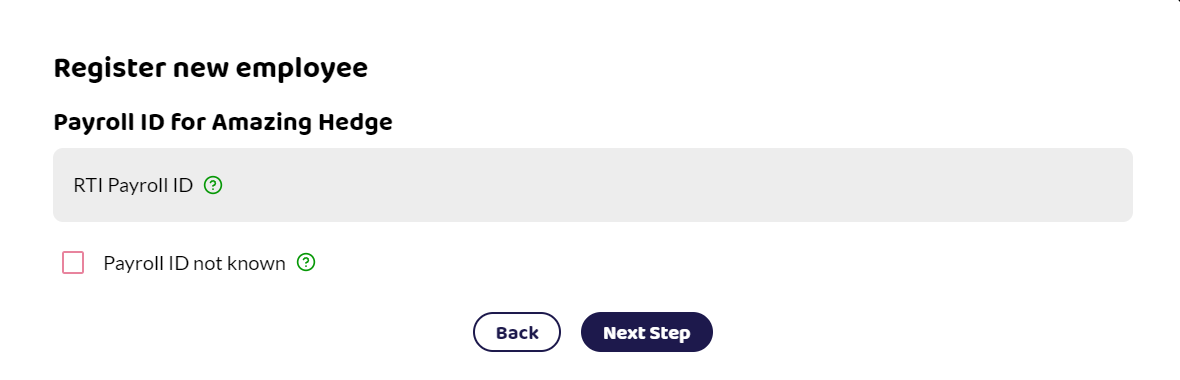

RTI Pay ID

If you have this set up in your previous system, you need to make sure you use the same ID, so that a duplicate record is not set up when you submit your information to HMRC.

If you are using RTI Payroll IDs, each employee will have a unique ID and you should be able to find this information in your employee details in your previous payroll software or in the last FPS you submitted. If a Pay ID has not been used, you can create one. Make sure that each employee has a unique ID. They can be numbers, letters, or a combination.

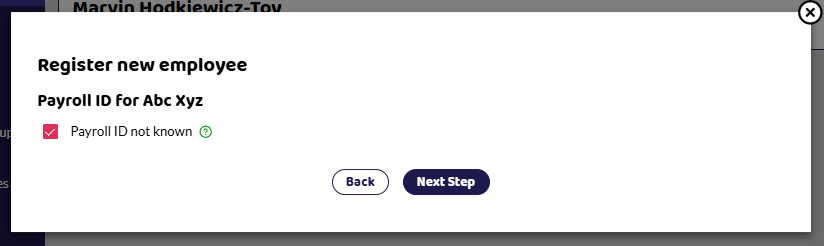

If you think an ID was used but you have no idea what it is, select Payroll ID not known. We will generate a new payroll ID for you, HMRC will be notified that the ID has changed in your next FPS.

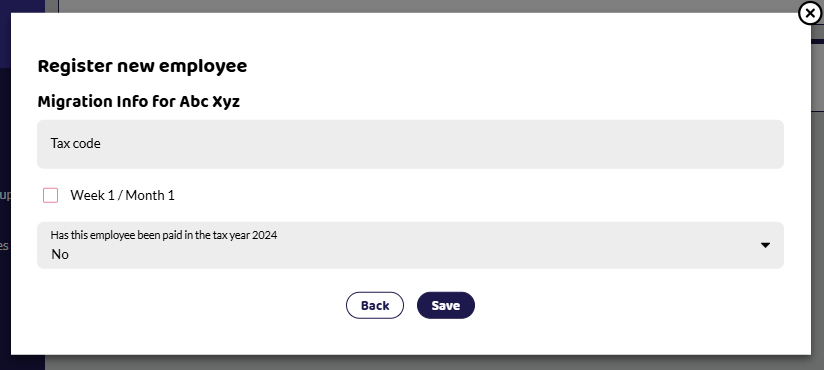

Tax Code

Put in the employee's current tax code and if they have a W1/M1, or X next to their number, for example, 1257L X, this would indicate that it is a Week1/Month 1 and the box should be ticked.

Paid in the current tax year

If you have paid the employee this tax year, you need to select Yes to the question "Has this employee been paid in the tax year 20XX?" and you'll then be able to enter the year-to-date values.

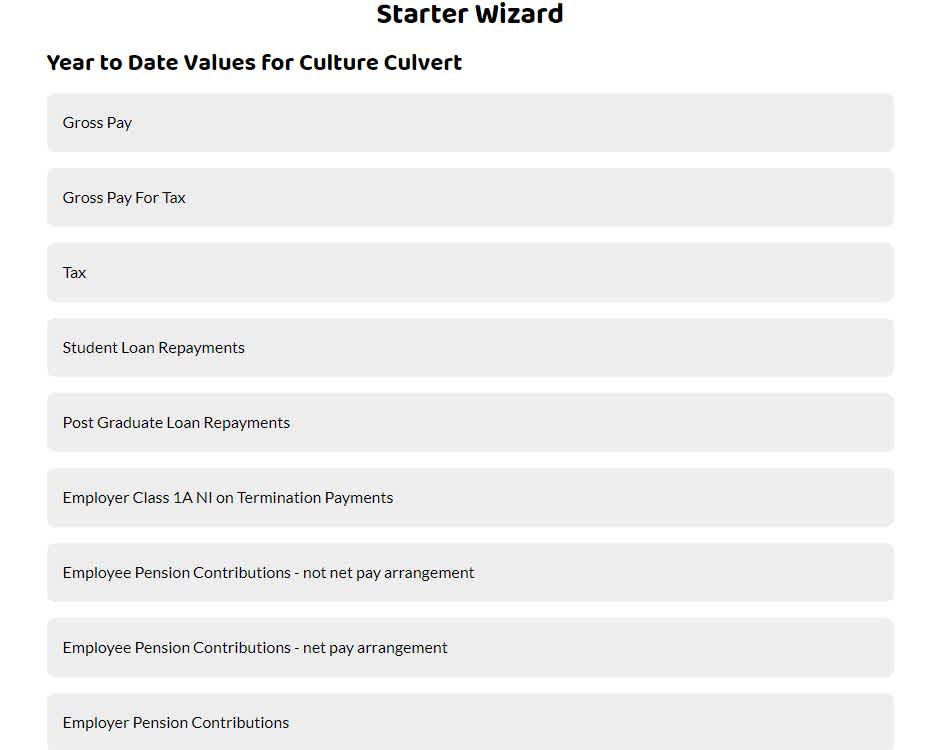

Year to Date Values

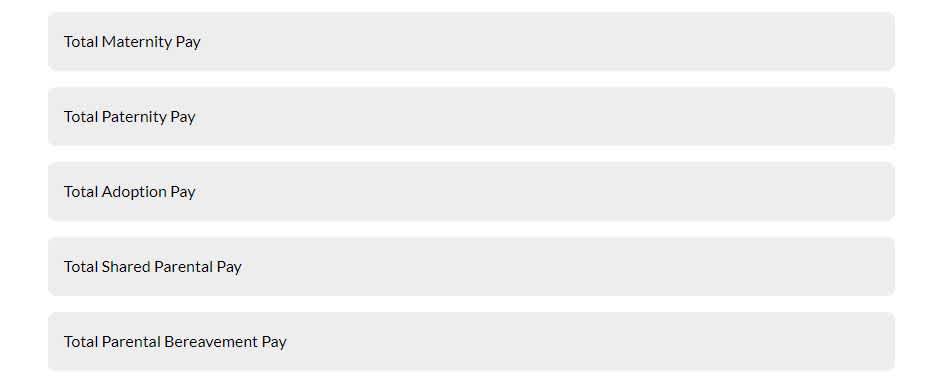

If you have paid the employee this financial year, you need to put in the year-to-date figures so that tax, national insurance, student loans, and pensions can be correctly worked out going forward. You should be able to find these details on your last submitted FPS or P11 if your previous software produces it. Use the YTD (Year-to-date) values and enter all relevant information.

Sometimes employees have more than one National insurance category within the same tax year, for example, they may have previously been an apprentice.

Previous Employment

If the employee has previous employment in the current tax year (6th April to 5th April), you need to make sure this is added to the previous employment section within the employee's screen. Do not add it to the migrating values above as the employee could end up paying too much tax.

Migrated Fixed Fee Support

If you would like support with migrating your data into Shape, we do offer a fixed fee for this service. Please see our Shape Consultancy Services page if you would like more information.