Where do I start?

You can have a play around with a test company before putting in all your details. Just sign up to a free account and find My Test Company under My Account once you have logged in.

Once you are ready to move on, have a look at our Steps to Complete a Successful Pay Run to help with where to start. We also suggest looking at HMRC guidance on employing staff for the first time and familiarising yourself with all your requirements as an employer if this is the first time you are running a payroll. At the end of our help articles, we give you some HMRC links for further reading.

If you have never completed a payroll, we would advise that you seek further guidance from an accountant or payroll expert.

I'm migrating from another system. What help can you give me?

We do offer support with a fixed fee for migrating your data into Shape. If this is something you would be interested in, please contact us. You can also read our guide Migrating Employees from another Payroll System on the key information you need to enter into Shape. You may also need to add Opening Figures if you are moving during a tax year.

Where can I find my account details, billing and invoices?

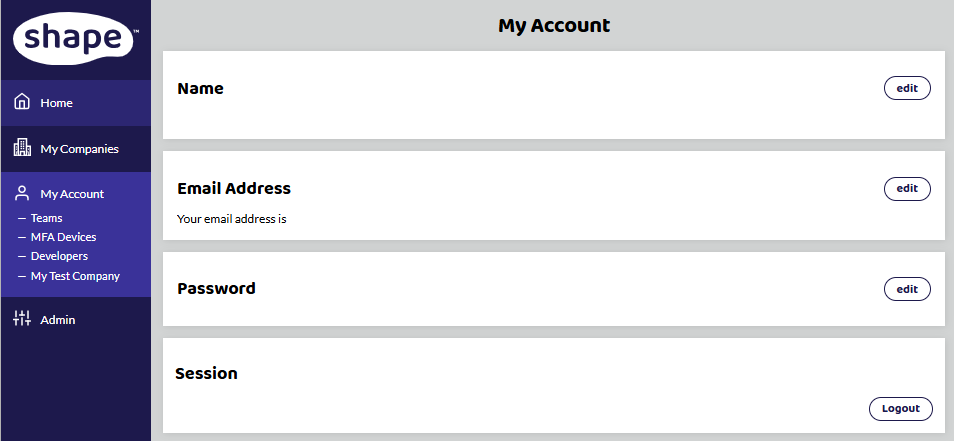

You can find this information under My Account on the left hand side of the screen.

My Account - You can change your name, email address, password, and end your session.

Teams - If you run lots of companies or you need someone else to access your payroll, you can invite them here.

Billing - You will find your billing plan and you can change your plan to suit your needs. If you are signed up to a subscription plan, you can update your payment method, either by paying by card or setting up a direct debit. You can also cancel your subscription here.

Invoices - You can download and print invoices for your records.

I've set the wrong date as my first pay run. How do I change it? It won't let me do it in the pay run.

You need to change the date in your pay run settings to change the first date of your pay run. If you have employees within the pay run, you need to remove them first. See How to remove an Employee from a pay run first and then follow the instructions in Pay Run Frequency Configuration.

I'm a director. What does it mean by annual or alternative?

There are two that a director can pay their national insurance contributions through PAYE. Please see our guide Who is a Director for NI Purposes and which calculation should I use? for further information.

Why isn't tax and national insurance calculating?

Shape calculates all tax and NI due so you don't have to. However, you need to make sure that you have entered in as much information about the employees including year to date figures if you are migrating and put in the correct tax code and NI category for the employee. Tax and National Insurance deductions are made after certain thresholds are reached depending on how much the employee is paid and how often. You can find the weekly and monthly thresholds on the HMRC website here: HMRC Rates and Thresholds for Employers 2022-23

Why are my RTI's failing?

Please see the guidance on RTI Error: Authentication Failure and work through the problems to see if this resolves your problems.

How do I delete my account?

We are sorry to see you go but if you need to delete all your account details, please email us at help@shapepayroll.com from the email address you signed up with so that we are able to find your account details quickly and help you.