When one of your employees leaves you will need to pay them their last wages, any holiday pay or statutory payments you owe them, issue them with a P45 and inform HMRC that they have left your employment.

You should start the process before you complete the final pay run for your employee. This can be up to 30 days before your employee is due to leave.

Paying Employee Again

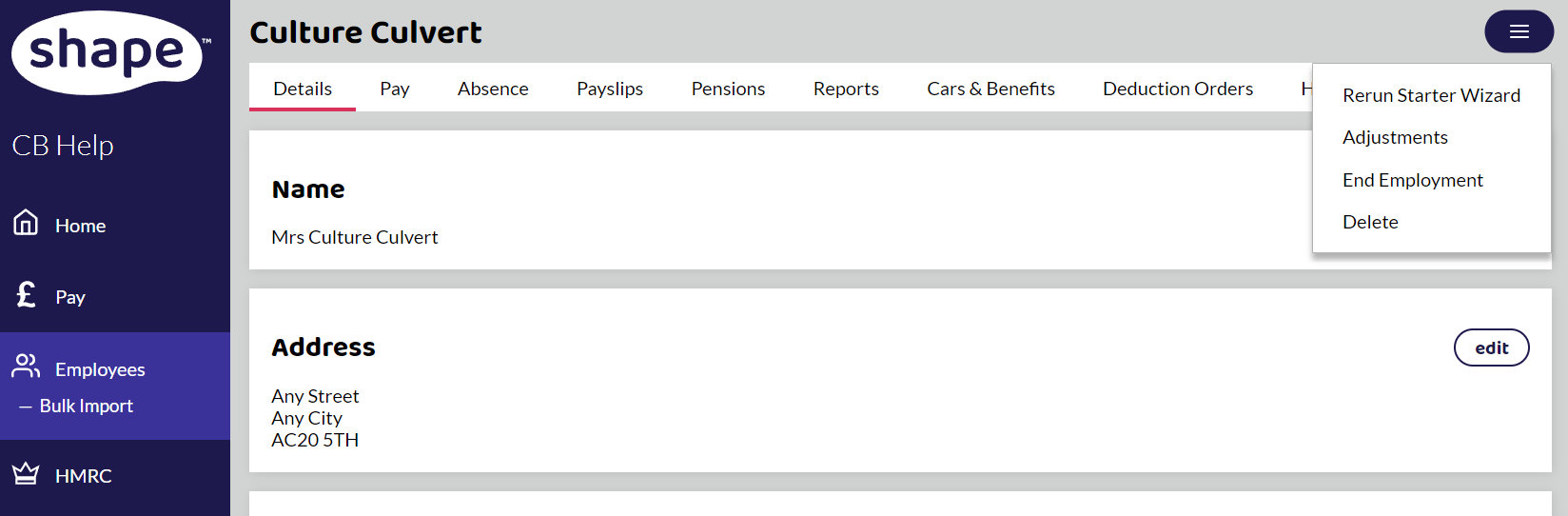

1. Select the employee

Go to Employees and select the employee you wish to make a leaver.

In the top right-hand corner, select the button and select ‘End Employment’.

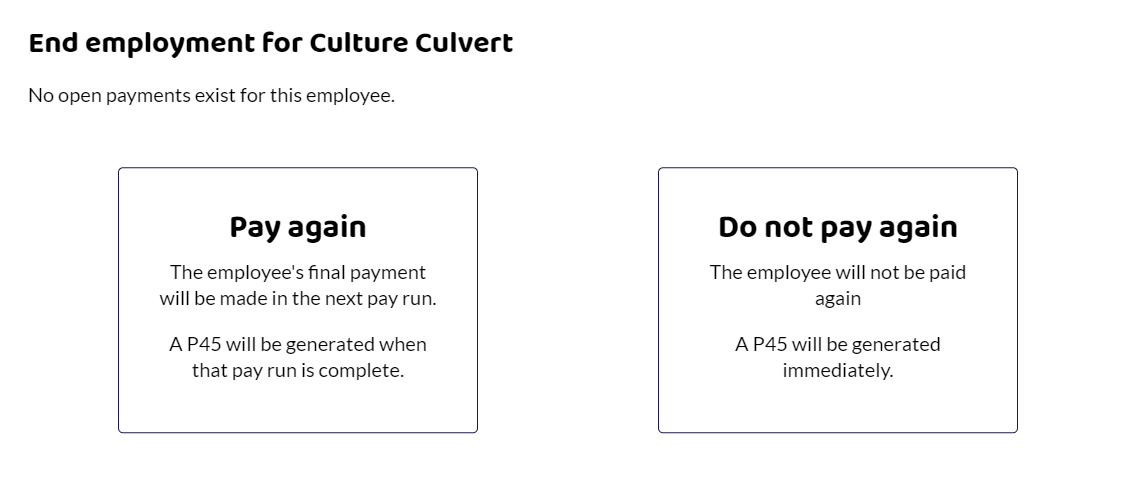

2. Choose if the employee needs to be paid again

If you do not have an open pay run, or the employee is an ad hoc employee, so that they aren't paid every pay run, you will get the option to pay them again or not pay them again.

If the employee is already in an open pay run, you will not get the above option, but move straight to step 3, to enter a leaving date as the system assumes you are paying the employee again. If you don't want to pay them again, remove them from the pay run. Remove Employee from Pay Run

3. Select Pay again

If you still need to make payments to the employee, select Pay Again, the employee will need to be included in the next pay run and a P45 will be generated once you have completed the final payment.

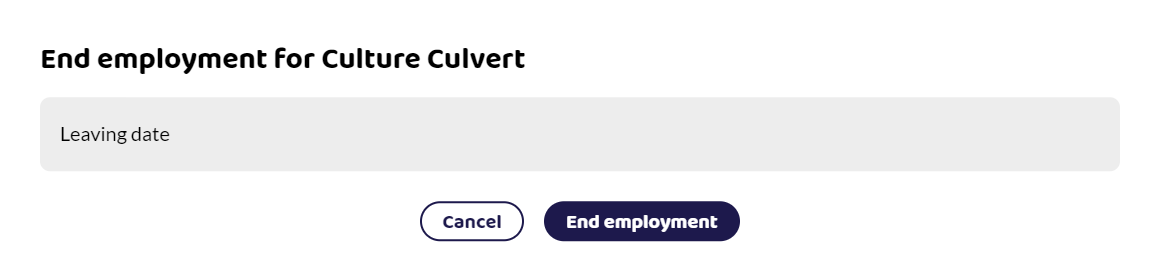

4. Enter the Leaving date

This date can be the last date the employee has worked, and been paid but must be no more than 30 days in the future. This will be the date that gets sent to HMRC and appears on the P45.

5. End Employment

Once you have ended the employment, you will need to:

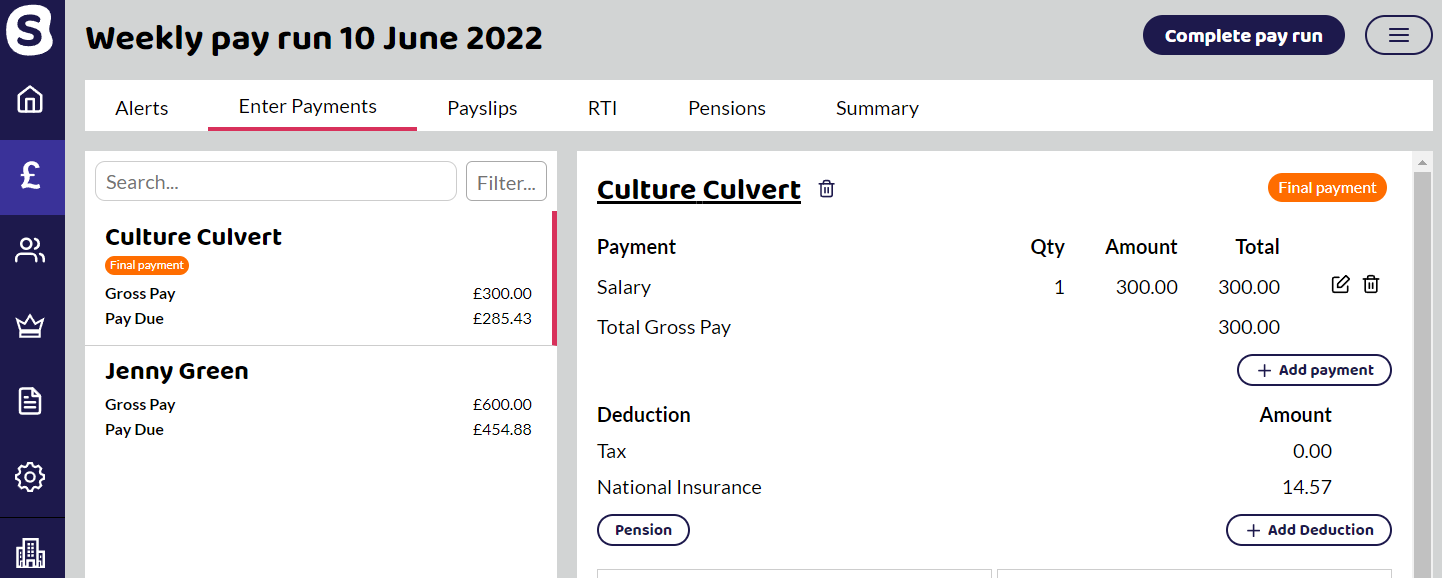

Pay the employee in the next pay run. A Final Payment flag will appear on the employee within the pay run to remind you.

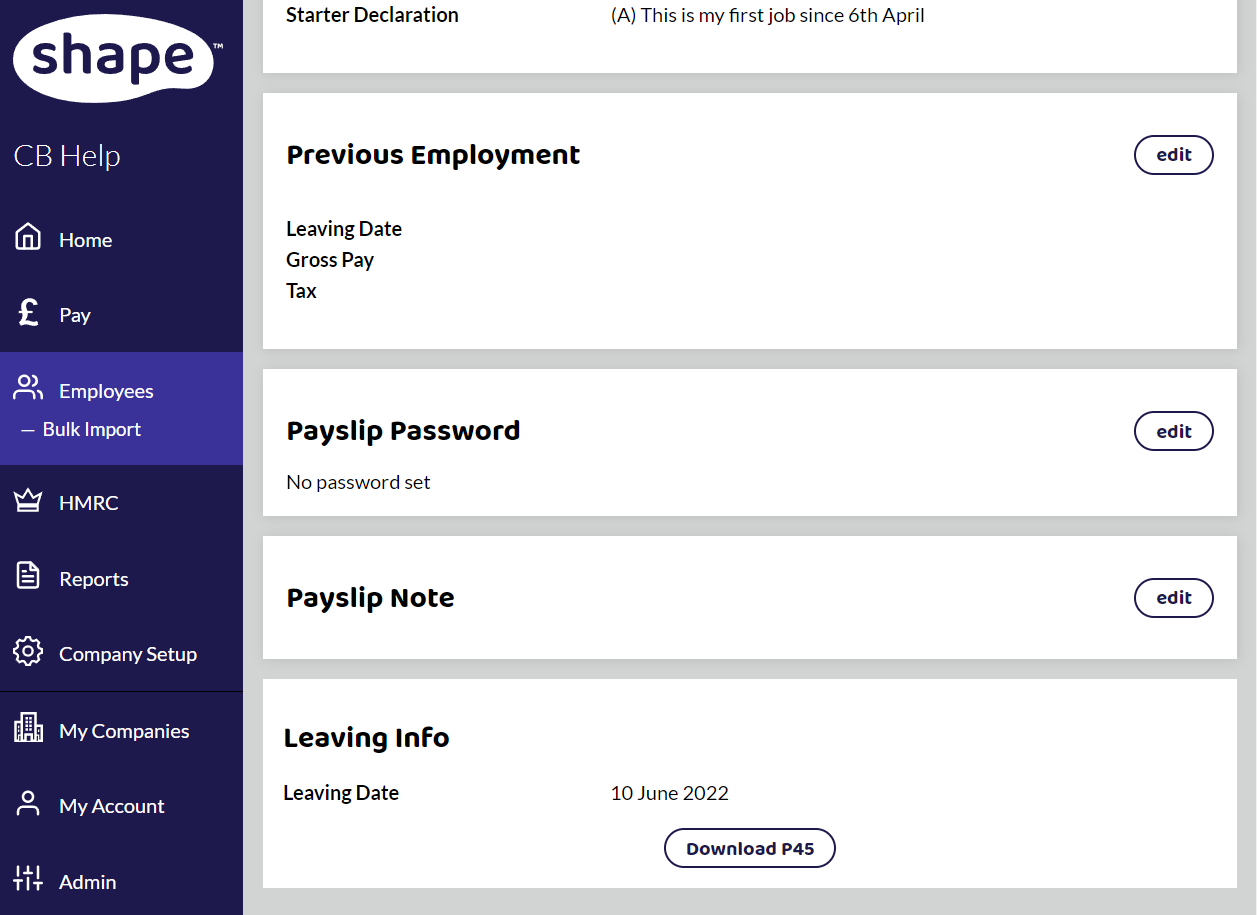

Complete the pay run and the employee's P45 will appear on the bottom of their page under Leaving Info. When you submit your Full Payment Submission to HMRC your employee’s leaving date will be included.

6. Send the employee the P45

Download the P45 and either print or email them a copy of the P45.

Not Paying the Employee Again

If you are not paying the employee again, you follow steps 1-3 above and then the P45 will be available straight away. The pay run that had the employee's last payment will be flagged as Final Payment and the next time you send an FPS, the employee will automatically be included.

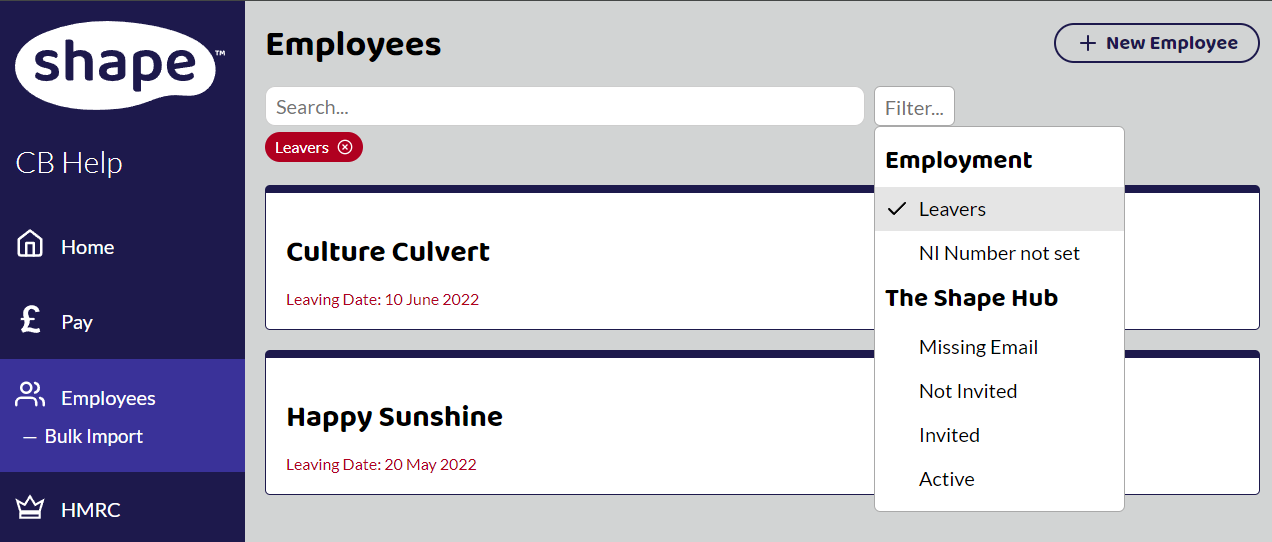

My employee's name has disappeared. How do I find them?

If you have made someone a leaver and the date has passed, the employee's details move into the Leaver screen. Toggle the Filter button next to the search box, select Leavers and your employee will be shown.

What if my employee leaves at the beginning of a month, but I pay at the end of the month? Can I give them a P45?

The payment date is a contractual agreement between you and the employee but you can process the payment when they leave and create a P45 for them.

Add the employee to the pay run for the current month, keep the payment date the same, and complete the pay run. Only submit the FPS if you do not have other employees in the pay run. You will then be able to give them a P45 which will be at the bottom of their employment details page. The reason for keeping a payment date the same is that if any employees are on universal credit they could be affected by an early payment date. Also for tax and NI purposes, they are still entitled to have their pay based on the full month.

But how do I add my other employees at the end of the month?

When you go to sort out the other employees at the end of the month, you can reopen the pay run, add the employees, complete the pay run and an FPS for both those employees will be produced for you to submit as normal.

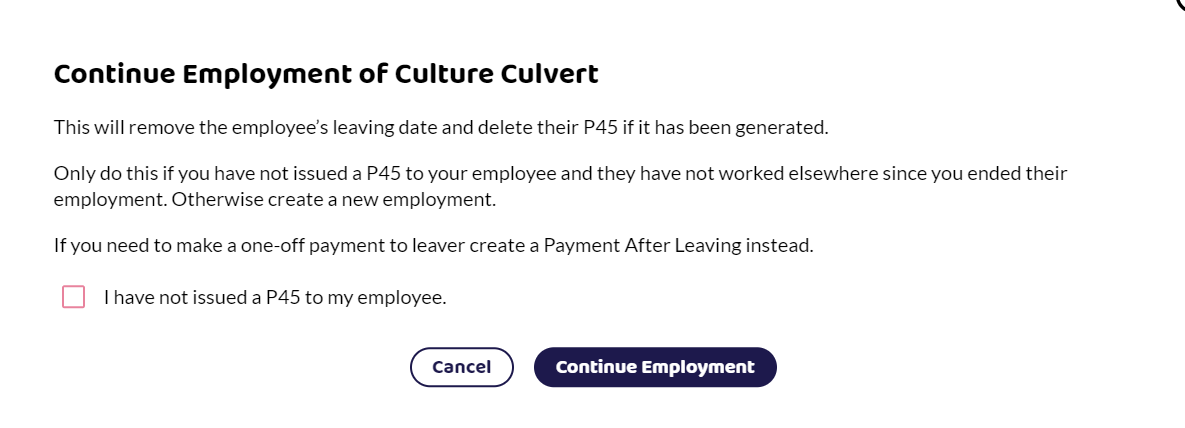

I've made my employee a leaver by mistake.

You can continue the employment if you have not given the employee a P45. Go to the employee's page, top right-hand corner and select the button. Instead of End Employment, there will be Continue Employment available.