Eligible employers can reduce their annual national insurance contributions by up to £5,000.

Applying for the Employment Allowance

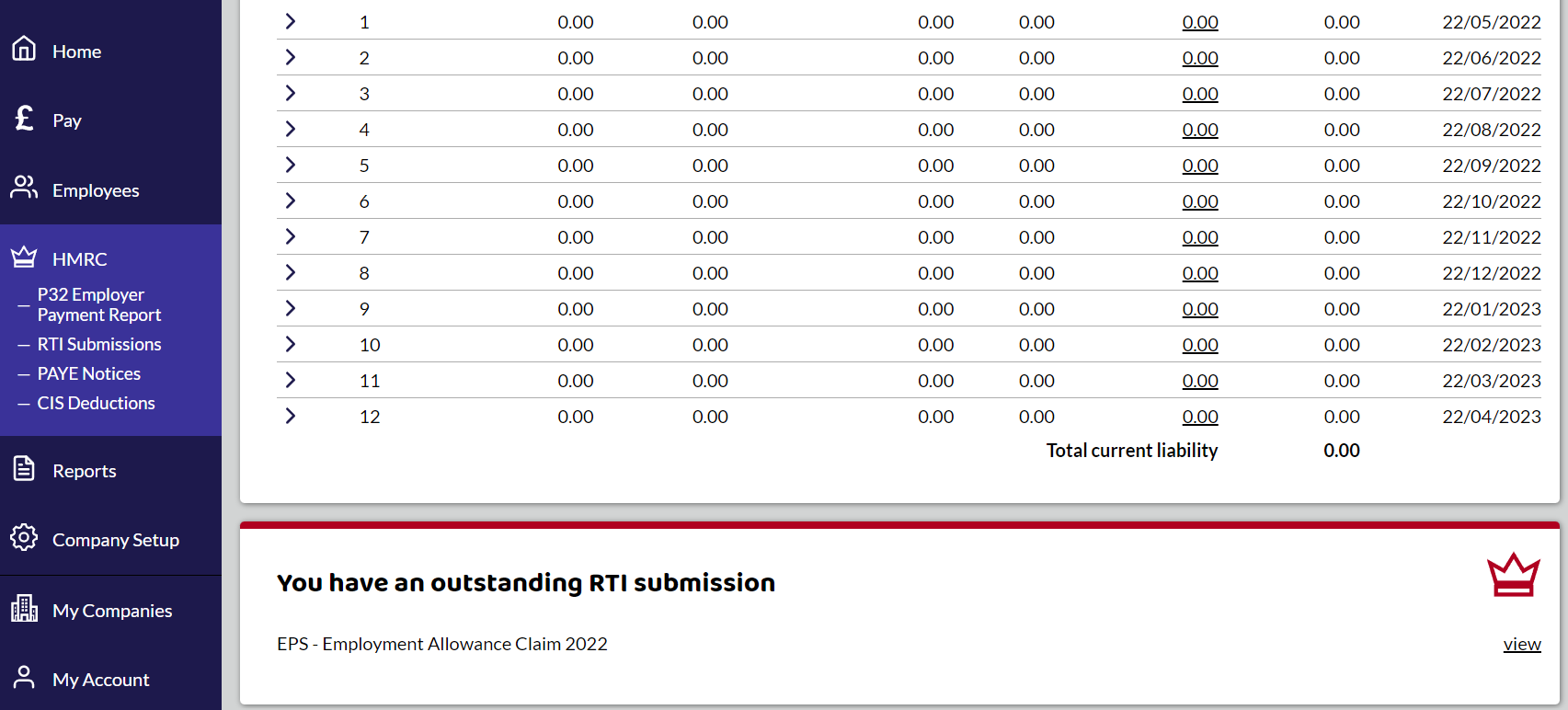

You only need to apply once a year and you will need to submit an EPS to tell HMRC you are eligible. If you are eligible, go to Tax Settings within Company Setup and select that the company is eligible. This will create the EPS Employment Allowance to be submitted. It can be found on the Homepage, under RTI Submissions and PAYE Liability page.

Eligibility

Businesses and charities can claim the employment allowance as long as the employer's National Insurance liabilities were less than £100,000 in the previous tax year.

Single Director only companies are not eligible. If a company has 1 director, even if they are earning above the threshold to pay employers NI, are not eligible.

There are various reasons why a company may not be eligible. For further guidance, please see here: HMRC Employment Allowance Guidance

How does HMRC apply the employment allowance?

Every time you complete payroll, employers' class 1 NI contributions are calculated and submitted to HMRC. HMRC will then credit your account with the employment allowance until the £5,000 has been used up for the tax year.

In Shape, you'll be able to see how much has been calculated and credited by looking at your HMRC PAYE liability page and a full breakdown can be found on the P32.

What if the EPS goes in late?

If you submit an EPS late in the tax year, then any payments you have made towards Employer NI during that tax year will be credited back to your account. These can then be used to pay towards any future liability.