An Employer Payment Summary (EPS) is part of the Real-Time Information reporting that can be sent once a month to HMRC to inform them of any statutory payment reclaims, apprenticeship levy and CIS deductions. Other types of EPS may only be sent once a year, for example, claiming the employment allowance or telling HMRC that a PAYE scheme has ceased.

Reasons to send an EPS

An Employer Payment Summary (EPS) needs to be sent to HMRC for the following reasons:

Statutory Payment Recovery - reclaim statutory maternity, paternity, adoption, parental bereavement or shared parental payments.

Apprenticeship Levy - If you need to tell HMRC that you need to pay the apprenticeship levy.

Employment Allowance Claim - submitted once a year.

CIS Deductions Claimed - submitted once a month if claiming. For limited companies only.

Bank Account Details - HMRC may ask you to send them your bank details in cases where you have requested a refund from them.

Create a No Payment - occasionally you may need to tell HMRC when you haven't paid any employees during a whole tax month.

Scheme Ceased - tell HMRC that you no longer require the PAYE scheme and not to expect any more submissions from your company.

The statutory payment recovery, apprenticeship levy and CIS deductions EPS is automatically generated for you if those apply for that tax month.

You need to send an EPS by the 19th of the following tax month for HMRC to apply any reduction (for example statutory pay) on what you owe for PAYE.

The tax month starts on the 6th and finishes on the 5th.

HMRC's further guidance about the EPS can be found here: Reporting to HMRC: EPS.

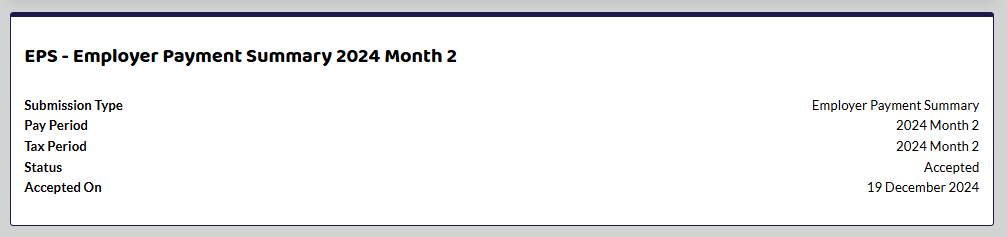

What confirmation do I get after I have submitted an EPS?

If your EPS has been received by HMRC you will see Accepted in the status field along with a sent and accepted by HMRC time and date.

You should also receive an email confirmation from HMRC.

My EPS has failed? What does it mean?

If the status shows failed, HMRC has rejected the EPS. The most common reason is an authentication error. Please see our guides within HMRC RTI Errors to see possible reasons HMRC may reject it.

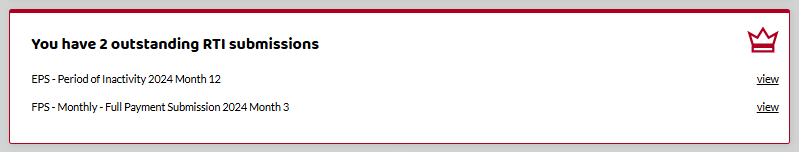

Where can I view my submissions in Shape?

All submissions can be found in the side menu under HMRC -> RTI Submissions. You can also link to this page from RTI Submissions on your homepage and any outstanding submissions will show as below.

When can I view my submissions in my HMRC account?

Submissions show up as a balance in your account at different times depending on when you submit them. To view the full breakdown of what was submitted to HMRC, you will need to view the details in Shape Payroll under HMRC -> RTI Submissions.

If you make a Full Payment Submission (FPS) on time, your balance will be updated by the 12th of the next month.

If you make a late FPS, see our article Sending a Late FPS or EPS and also read the GOV.UK guide on payroll.

If HMRC receives an Employer Payment Summary (EPS) between the 20th and the 5th of the month, your balance will be updated by the 12th of the next month.

If they receive an EPS between the 6th and the 19th of the month, your balance will be updated within 1 day.