Director payroll can be set up just as any employee would be except that there will be a difference in how the National Insurance Contributions are worked out. For more information see Directors NIC.

Adding a Director as an employee

When setting up the Director, you can use the Starter Wizard in the employee section and go through the steps. The difference comes when setting the director's pay pattern and director details.

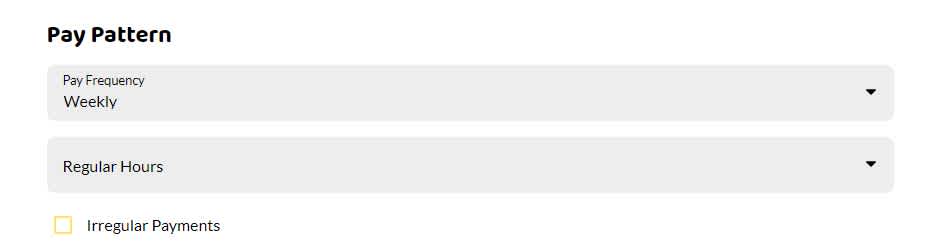

Pay Pattern

The pay frequency will be based on what you have set up in pay run settings - this is how often you want to make payments e.g. weekly, monthly or annual.

If a director is not paid regularly, then the Irregular Payments box should be checked. If a director is paid on an irregular basis, and in some months no payments are made due to being the only employee, you may need to send a No Payment EPS to HMRC to make sure they don't send estimated charges.

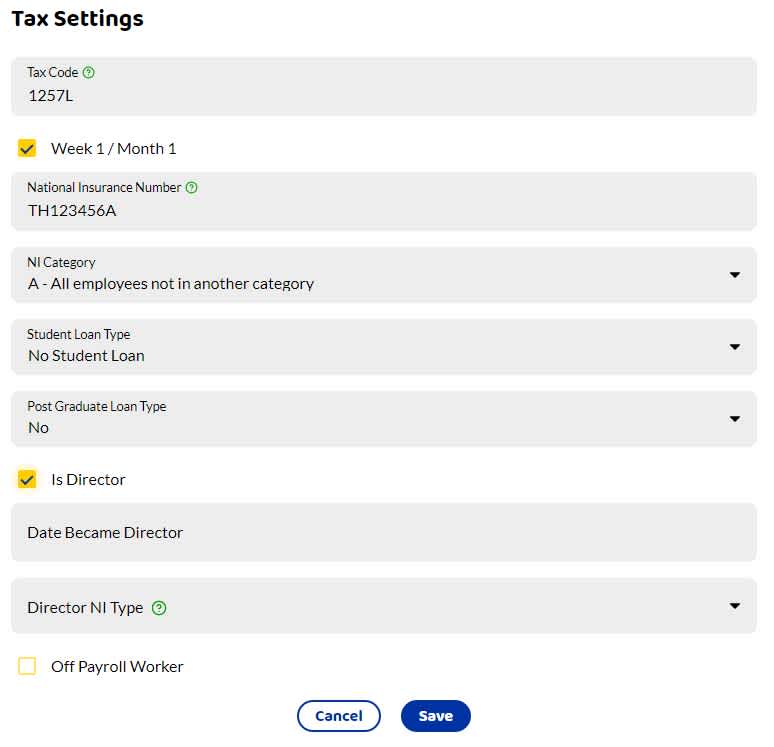

Tax Settings

In Tax Settings, check the Is Director box and two new sections will show.

Date Became Director - this is the date the employee became a director. If the date is sometime during the current tax year, the director's NIC will be pro-rated.

Director NI Type - Choose between annual and alternative.

Running an Annual Payroll Scheme

Some directors only want to pay themselves once a year. An annual payroll can be set up in the pay run settings. This means only one payment is made in the financial tax year. The conditions of an annual payroll scheme are that:

All employees are paid once at the same time;

One payment of any liabilities is paid over to HMRC.

To run an annual payroll scheme, you need to inform HMRC and let them know what month the payment to the director or employees will be.

HMRC Further Guidance

Running payroll: Changing Paydays - Under the Annual payroll Scheme for PAYE details how to inform HMRC if you want to run an Annual Payroll Scheme.