Where can I enter a deduction order for my employee on Shape?

Within the employee profile in Shape is a tab named "Deduction Orders", this is where to input any deduction order instructions you have received for an individual.

Once set up, the deduction order will continue to be deducted unless you instruct Shape payroll to end the deduction order by way of an end date (of course, only advisable if you have been instructed to do so by the governing body in writing) or if a total amount due has been exhausted.

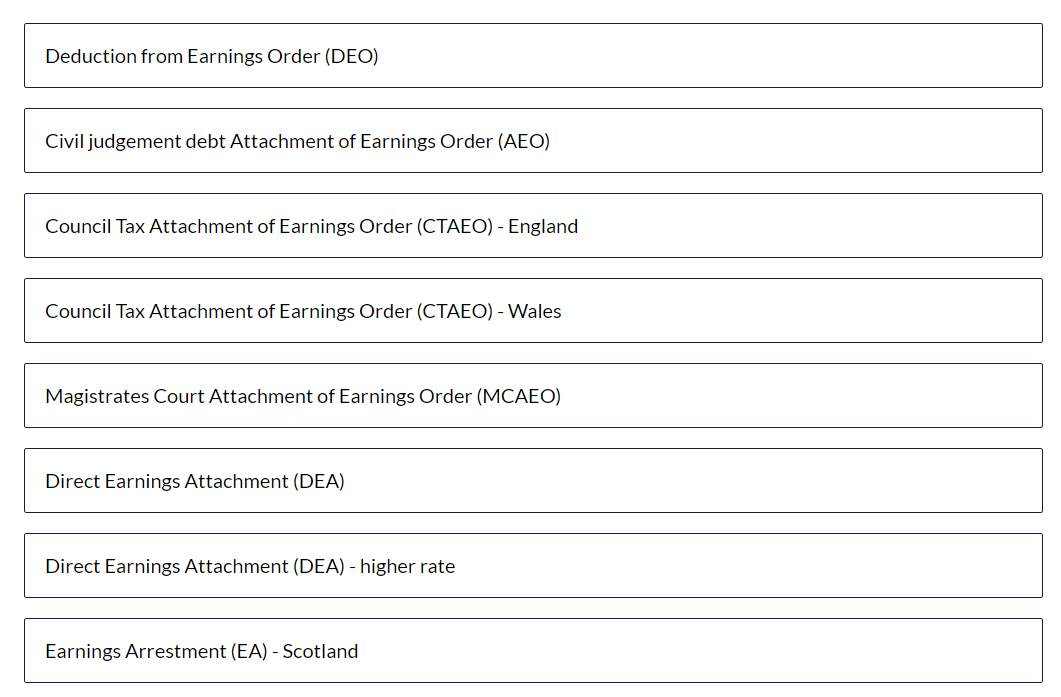

What are the deduction order options within Shape?

What are the deduction order calculations in Shape?

Deduction from Earnings Order (DEO)

This is where you would enter Child Maintenance deduction orders which are not calculated on a percentage basis but use the period amounts given, alongside protected earnings, within the deduction order letter.

You can also use the DEO field to deduct a fixed amount for other deduction orders when instructed to.

Civil judgment debt Attachment of Earnings Order (AEO)

This is where you would enter court orders which are not calculated on a percentage basis but use the period amounts given, alongside protected earnings and total amount owed, within the court order letter.

Council Tax Attachment of Earnings Order (CTAEO) - England

Table 1 - Deductions from weekly earnings

Net earnings | Deduction rate (percentage) |

|---|---|

Not exceeding £75.00 | Nil |

Exceeding £75.00 but not exceeding £135.00 | 3 |

Exceeding £135.00 but not exceeding £185.00 | 5 |

Exceeding £185.00 but not exceeding £225.00 | 7 |

Exceeding £225.00 but not exceeding £355.00 | 12 |

Exceeding £355.00 but not exceeding £505.00 | 17 |

Exceeding £505.00 | 17 in respect of the first £505.00 and 50% in respect of the remainder |

Table 2 - Deductions from monthly earnings

Net earnings | Deduction rate (percentage) |

|---|---|

Not exceeding £300.00 | Nil |

Exceeding £300.00 but not exceeding £550.00 | 3 |

Exceeding £550.00 but not exceeding £740.00 | 5 |

Exceeding £740.00 but not exceeding £900.00 | 7 |

Exceeding £900.00 but not exceeding £1420.00 | 12 |

Exceeding £1420.00 but not exceeding £2020.00 | 17 |

Exceeding £2020.00 | 17 in respect of the first £2020.00 and 50% in respect of the remainder |

Council Tax Attachment of Earnings Order (CTAEO) - Wales

Weekly Table

Net Earnings (Welsh Orders) from 01 April 2022 | Deduction Rate (%) |

|---|---|

Not Exceeding £105 | 0 |

Exceeding £105 but not exceeding £190 | 3 |

Exceeding £190 but not exceeding £260 | 5 |

Exceeding £260 but not exceeding £320 | 7 |

Exceeding £320 but not exceeding £505 | 12 |

Exceeding £505 but not exceeding £715 | 17 |

Exceeding £715 | 17 on first £715 and 50 on net earnings over |

Monthly Table

Net Earnings (Welsh Orders) from 01 April 2022 | Deduction Rate (%) |

|---|---|

Not Exceeding £430 | 0 |

Exceeding £430 but not exceeding £780 | 3 |

Exceeding £780 but not exceeding £1,050 | 5 |

Exceeding £1,050 but not exceeding £1,280 | 7 |

Exceeding £1,280 but not exceeding £2,010 | 12 |

Exceeding £2,010 but not exceeding £2,860 | 17 |

Exceeding £2,860 | 17 on first £2,860 and 50 on net earnings over |

Magistrates Court Attachment of Earnings Order (MCAEO)

Table A - Deductions from weekly earnings

Net Earnings | Deduction Rate % |

|---|---|

Not exceeding £55.00 | Nil |

Exceeding £55.00 but not exceeding £100.00 | 3 |

Exceeding £100.00 but not exceeding £135.00 | 5 |

Exceeding £135.00 but not exceeding £165.00 | 7 |

Exceeding £165.00 but not exceeding £260.00 | 12 |

Exceeding £260.00 but not exceeding £370.00 | 17 |

Exceeding £370.00 | 17 in respect of the first £370.00 and 50% in respect of the remainder |

Table B - Deductions from monthly earnings

Net Earnings | Deduction Rate % |

|---|---|

Not exceeding £220.00 | Nil |

Exceeding £220.00 but not exceeding £400.00 | 3 |

Exceeding £400.00 but not exceeding £540.00 | 5 |

Exceeding £540.00 but not exceeding £660.00 | 7 |

Exceeding £660.00 but not exceeding £1040.00 | 12 |

Exceeding £1040.00 but not exceeding £1480.00 | 17 |

Exceeding £1480.00 | 17 in respect of the first £1480.00 and 50% in respect of the remainder |

Direct Earnings Attachment (DEA) - Standard Rate

Table A: Deductions from earnings rate (standard)

Weekly Earnings | Monthly Earnings | Deduction rate to apply (percentage of net earnings) |

|---|---|---|

Up to £100 | Up to £430 | Nil |

Between £100.01 and £160 | Between £430.01 and £690 | 3 |

Between £160.01 and £220 | Between £690.01 and £950 | 5 |

Between £220.01 and £270 | Between £950.01 and 1160 | 7 |

Between £270.01 and £375 | Between £1160.01 and £1615 | 11 |

Between £375.01 and £520 | Between £1615.01 and £2240 | 15 |

£520.01 or more | £2240.01 or more | 20 |

Note: Net earnings are gross pay, less income tax, Class 1 National Insurance and superannuation contributions as per HMRC guidelines

Direct Earnings Attachment (DEA) - Higher Rate

Table B: Deductions from earnings rate (higher)

Weekly Earnings | Monthly Earnings | Deduction rate to apply (percentage of net earnings) |

|---|---|---|

Up to £100 | Up to £430 | 5 |

Between £100.01 and £160 | Between £430.01 and £690 | 6 |

Between £160.01 and £220 | Between £690.01 and £950 | 10 |

Between £220.01 and £270 | Between £950.01 and 1160 | 14 |

Between £270.01 and £375 | Between £1160.01 and £1615 | 22 |

Between £375.01 and £520 | Between £1615.01 and £2240 | 30 |

£520.01 or more | £2240.01 or more | 40 |

Earnings Arrestment (EA) - Scotland

Table A - Deductions from weekly earnings

Net earnings | Deduction |

|---|---|

Not exceeding £150.94 | Nil |

Exceeding £150.94 but not exceeding £545.57 | £4.00 or 19% of earnings exceeding £150.94, whichever is greater |

Exceeding £545.57 but not exceeding £820.21 | £74.98 plus 23% of earnings exceeding £545.57 |

Exceeding £820.21 | £138.15 plus 50% of earnings exceeding £820.81 |

Table B - Deductions from monthly earnings

Net earnings | Deduction |

|---|---|

Not exceeding £655.83 | Nil |

Exceeding £655.83 but not exceeding £2,370.49 | £15.00 or 19% of earnings exceeding £655.83, whichever is greater |

Exceeding £2,370.49 but not exceeding £3,563.83 | £325.79 plus 23% of earnings exceeding £2,370.49 |

Exceeding £3,563.83 | £600.25 plus 50% of earnings exceeding £3,563.83 |