You have realised that a payment made to an employee in a previous tax year was incorrect or missed. You need to go back and correct this. Shape allows you to edit the pay runs in previous tax years and submit a correction to HMRC.

When editing a previous tax year, any corrections that need to be submitted to HMRC after 19th April, need to be sent on a Month 12 additional FPS. This sends the correct year to date for the employee.

Information to collect before editing pay runs

You will need to gather all the information before making changes as this will help you to make accurate amendments. A change in pay either an addition or deduction, may result in a net pay change where either you owe the employee and HMRC more money or the employee may owe you money.

What pay runs are affected?

What was the pay before? How much net pay was paid to the employee?

What payments are needed to be added or deducted?

How much was paid to HMRC during that period?

What was the employee's tax code at the point of payment? You will be able to review this by going into the pay run and looking at the tax details on the payments screen. If it is different than what it is currently, you will need to edit the employee's tax code in their record with the previous tax code before editing the pay run. Please see Editing an Employees Details for more information. Once you have made the changes needed for the previous tax year, you can change it back before continuing with the current tax year.

Let's look at an example of how to edit a previous year's pay run and submit corrections.

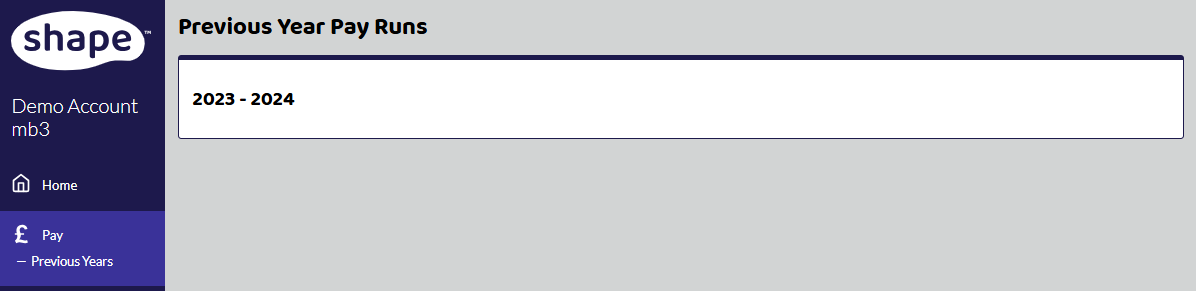

1. Go to Previous tax year

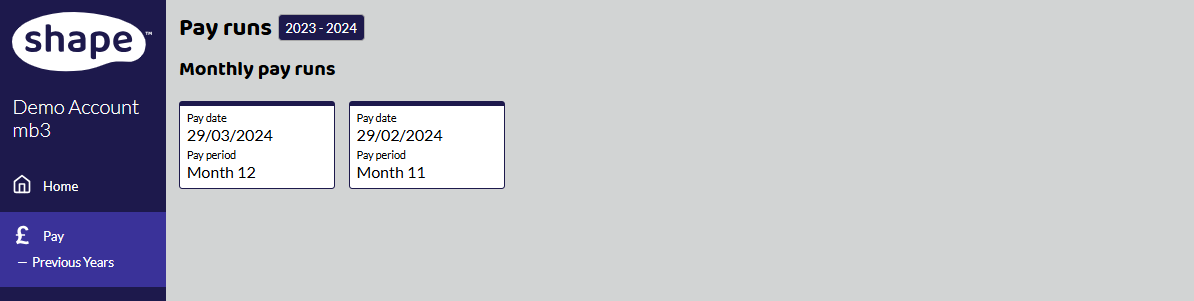

If you want to edit a pay run for the previous tax year, select Pay -> Previous Years and select the correct tax year.

Here all your complete pay runs for that tax year will show. This company runs two monthly pay runs.

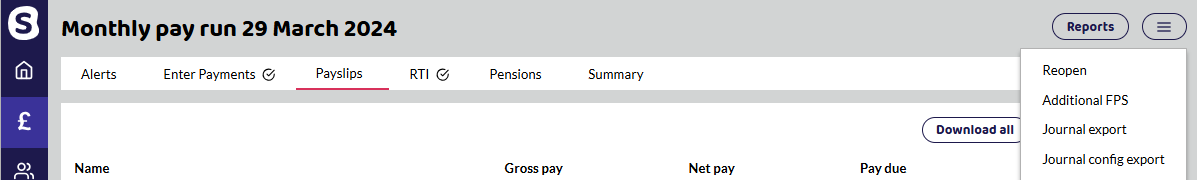

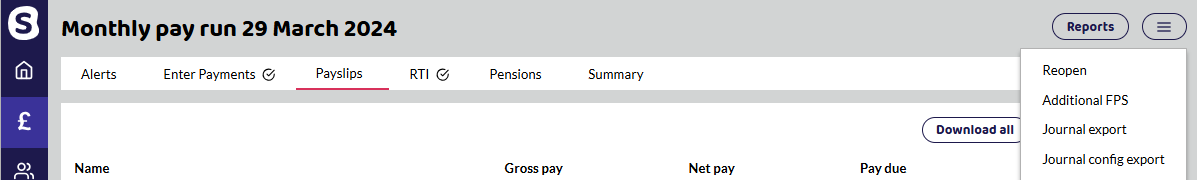

Select the pay run you wish to edit. We are going to edit the Monthly pay run on 29 March 2024. Select the pay run, top-right-hand corner, click button -> select Reopen.

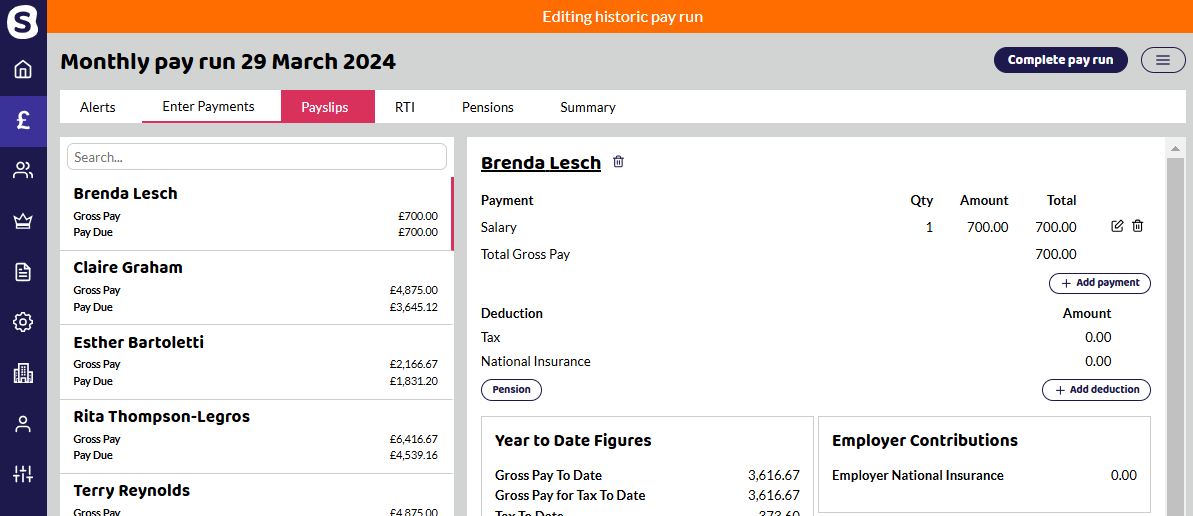

2. Make the changes

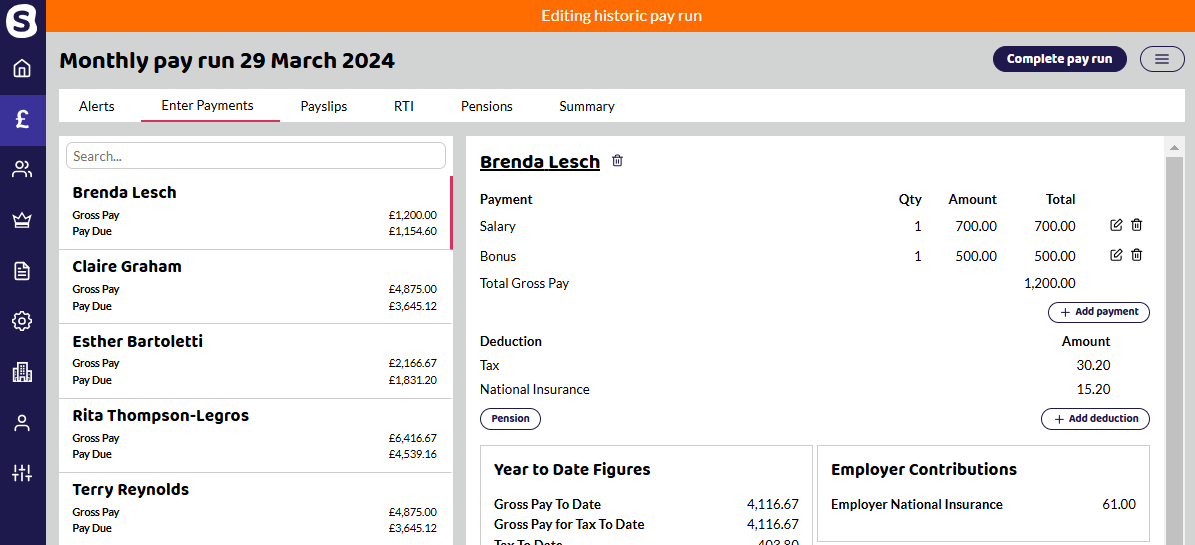

Once open the pay run will show that you are editing a historic pay run. Select Enter Payments and the employee you want to edit.

Culture Culvert is a director who received a bonus in March but it wasn't added to payroll at the time.

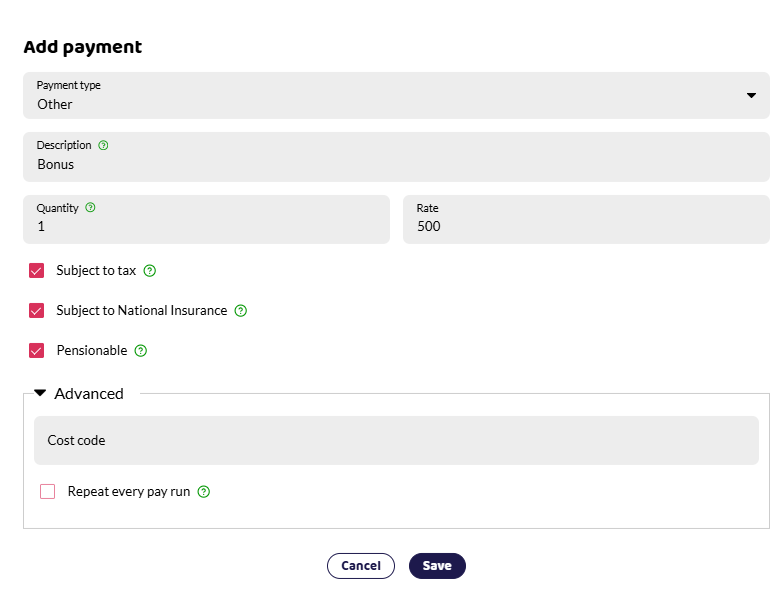

Add the payment or deduction. As with adding payments normally, you can choose different payment types and depending on the type choose whether they are subject to tax, NI, pensionable or a regular payment. You may wish to untick the Repeat every pay run box if it's a one-off payment.

Because there isn't any tax, national insurance or pension to pay, the employee has been given the full amount and the net pay has increased from £700 to £1,200. So the extra payment the employer needs to make to the employee is £454.60. What has also changed, is that there is now an Employee's tax and Employee and Employer National Insurance Contribution to pay. This difference would now need to be paid over to HMRC unless the employment allowance is claimed and there may be some of the allowance left for that tax year to cover it.

You are now ready to complete the pay run and create an additional FPS to send the correction to HMRC.

3. Create an Additional FPS

As it is month 12 that is being updated, you can create the additional FPS and send the correct year to date figures to HMRC.

Select the pay run, top-right-hand corner, click button -> select Additional FPS.

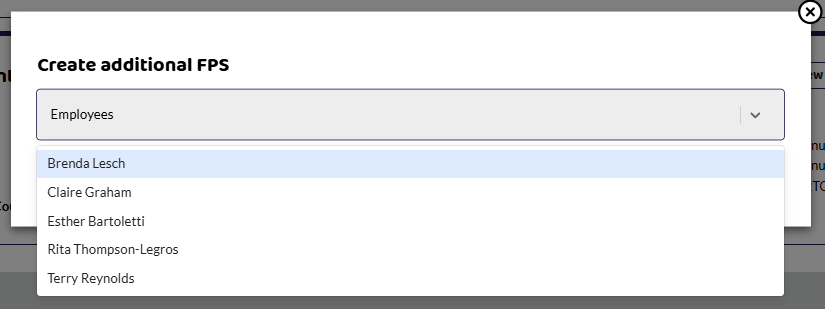

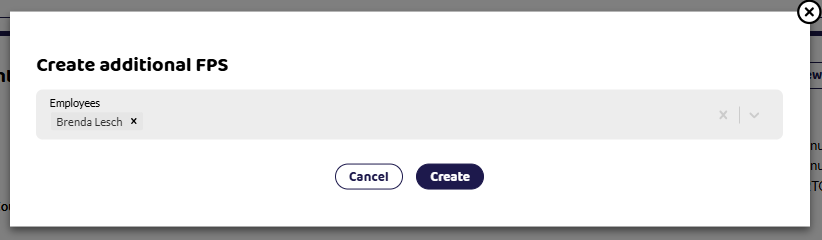

You will be given an option in the drop down to add the employee who you need to send a correction for. In this case, it is Culture Culvert. If you had a few employees to amend, you can add them all here to send as one FPS correction.

If you have selected the wrong person, you can select the x next to their name to remove them.

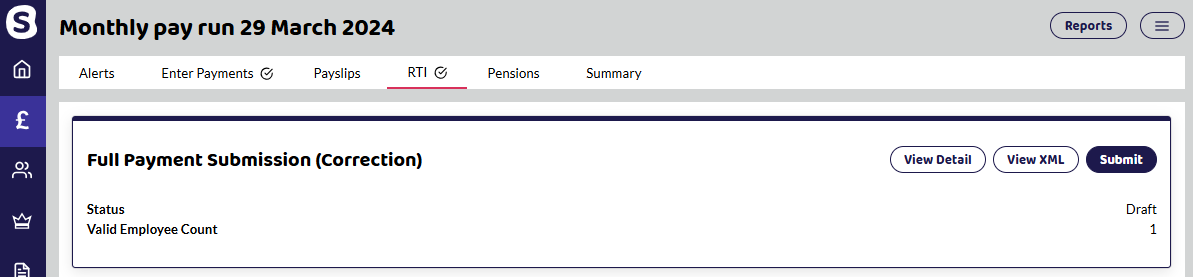

Select Create and a Full Payment Submission (Correction) will be created.

As with all FPS Submissions, you can either View Detail or View XML for a breakdown of what is being submitted to HMRC.

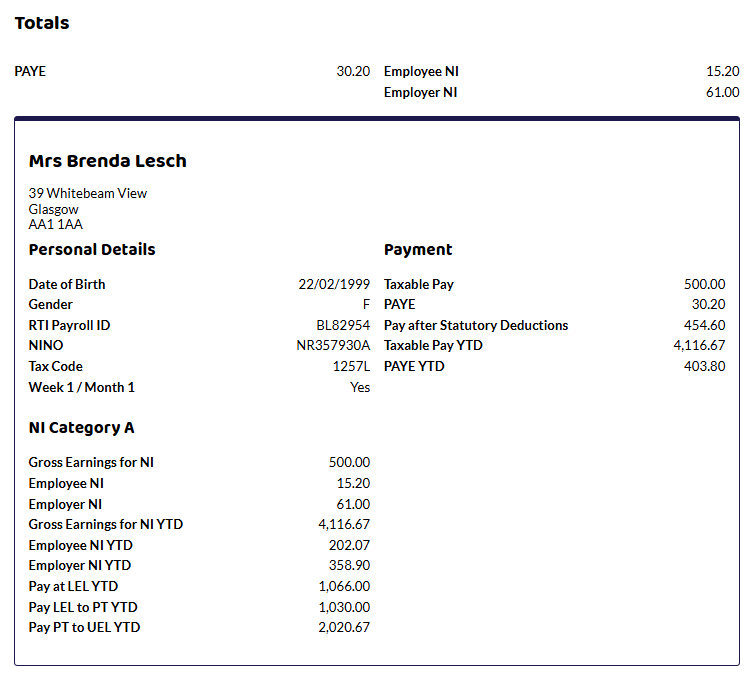

Here you can see that the extra £500 of taxable pay and NI has been submitted as well as the additional Tax and Ni. This is because HMRC records already have a record of the £700 and only the difference needs to be submitted. The Year to Date figures have been updated.

5. Pay over the difference and send new documentation.

Now you have the net pay difference, you need to send the payments to the correct places. You may have payments to make to the employee, HMRC and pensions.

If the employee has been issued with a P60 already, you would need to send them a letter detailing the difference, with a copy of the new P60 and mark as 'replacement'.

If you have not issued the P60, it will have been updated and you can send it to the employee.