Only limited companies can claim back the CIS deductions through their company's monthly payroll. With Shape, you can input your invoices and offset this against your monthly PAYE liability.

Sole traders and partners will need to claim the deductions through a Self Assessment tax return.

If you have CIS deductions to reclaim you need to keep a record of the invoices and put through the correct month so that an EPS can be created to submit to HMRC to tell them how much you are reclaiming against your PAYE liability.

Recording CIS deductions

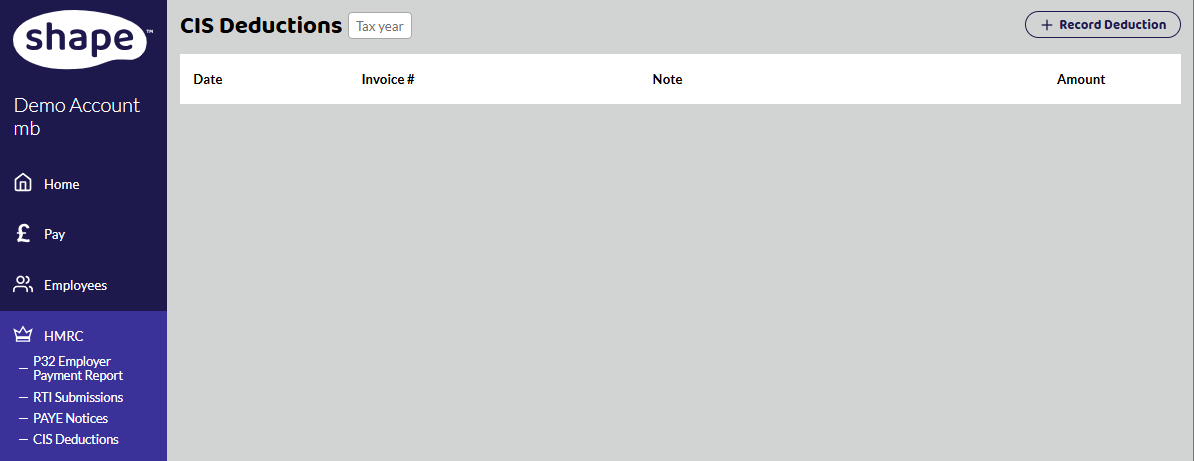

You can find CIS Deductions under the HMRC tab in the side menu.

Here is where you will keep your records.

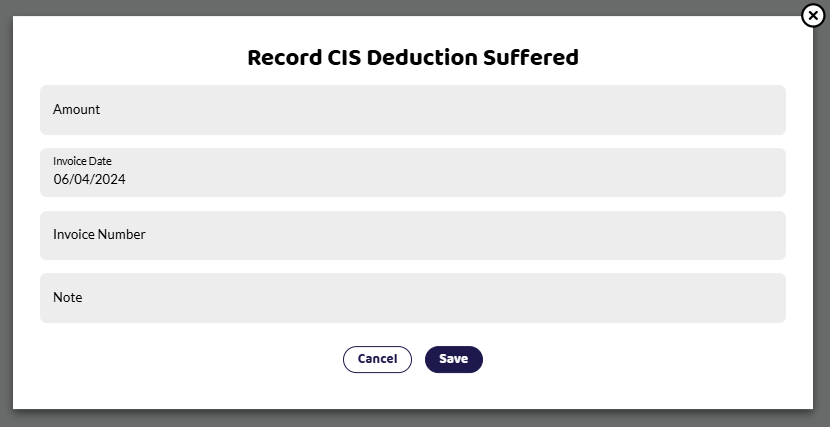

Select + Record Deduction to add an invoice.

You enter the amount, Invoice date, and invoice number and you can make notes. You can leave the invoice number blank if there isn't one, or put in a reference.

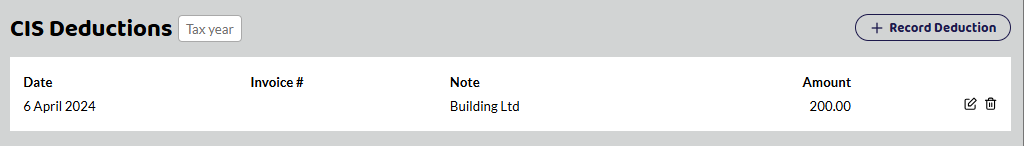

This deduction will then appear in two places.

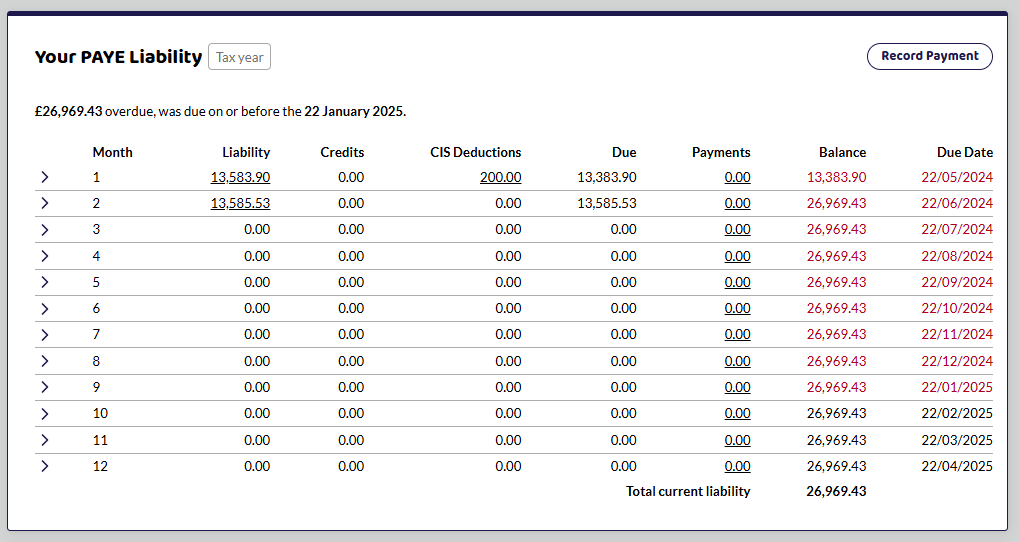

Your PAYE liability

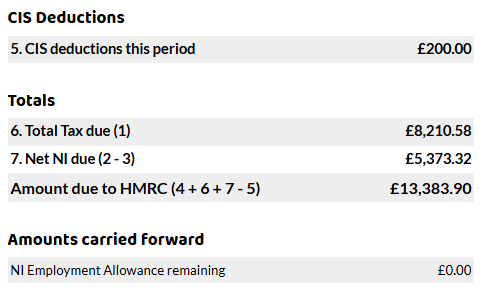

The CIS deduction will appear under CIS deductions in the month the invoice applies to. You can click on the amount and this will take you to the P32, where you will get a full breakdown of the PAYE liabilities for that month.

P32

The deduction will also appear on the monthly P32.

Once there is a CIS deduction added to the PAYE and all pay runs in that period are complete an EPS will be created to submit the correct figures to HMRC.

Previous tax years

You may need to claim back CIS deductions from a previous tax year. Please see the HMRC link below.