Once you are set up to receive PAYE notices online (see our PAYE Notices Overview if you are still receiving notices by post) you can check for notices and apply them to employees.

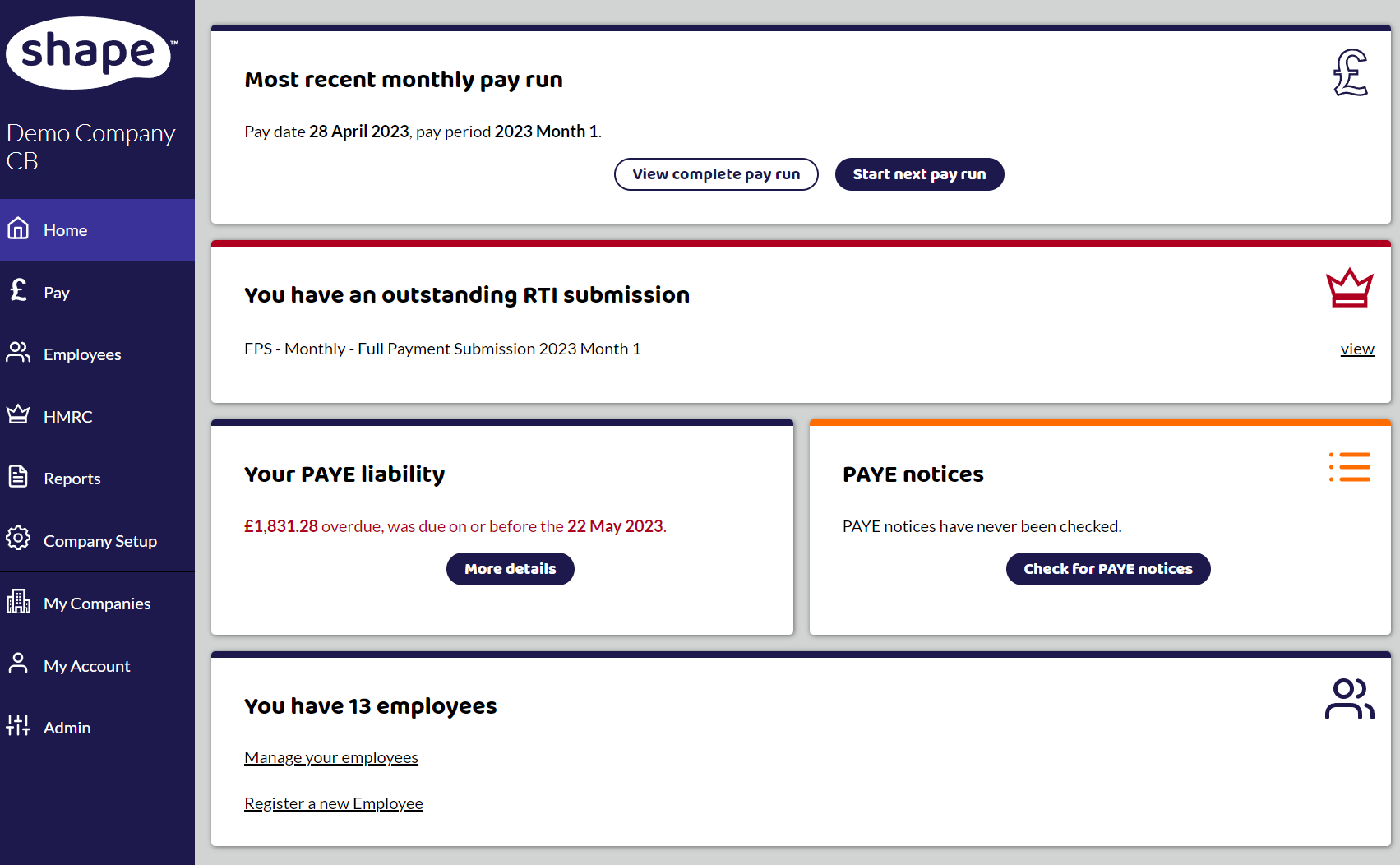

If you have never checked for PAYE notices, the homepage has a warning and shows when the last time they were checked.

Here the homepage shows that PAYE Notices have never been checked for this company.

Click check now and depending on how long the company has been receiving online notices, there could be a long list that needs to be applied or ignored. If you need to ignore PAYE Notices, due to the amount received, see Ignore PAYE Notices.

Apply and Filter Notices

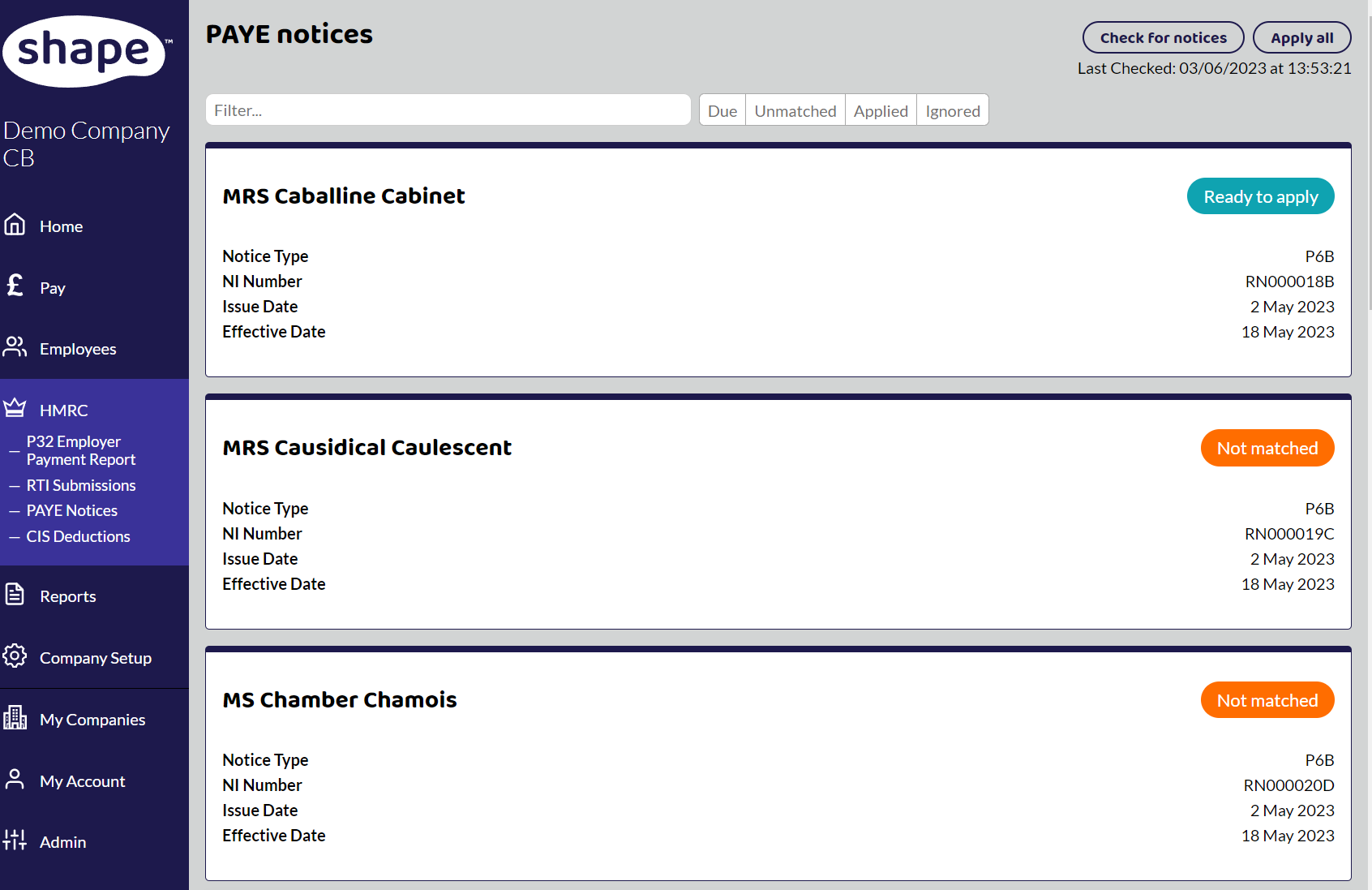

Once you have checked, you will be able to review all the notices. There a a range of filters that can be used to find notices, including typing the name of the employee in the Filter box.

Here there is one notice Ready to Apply and some notices that have not been matched.

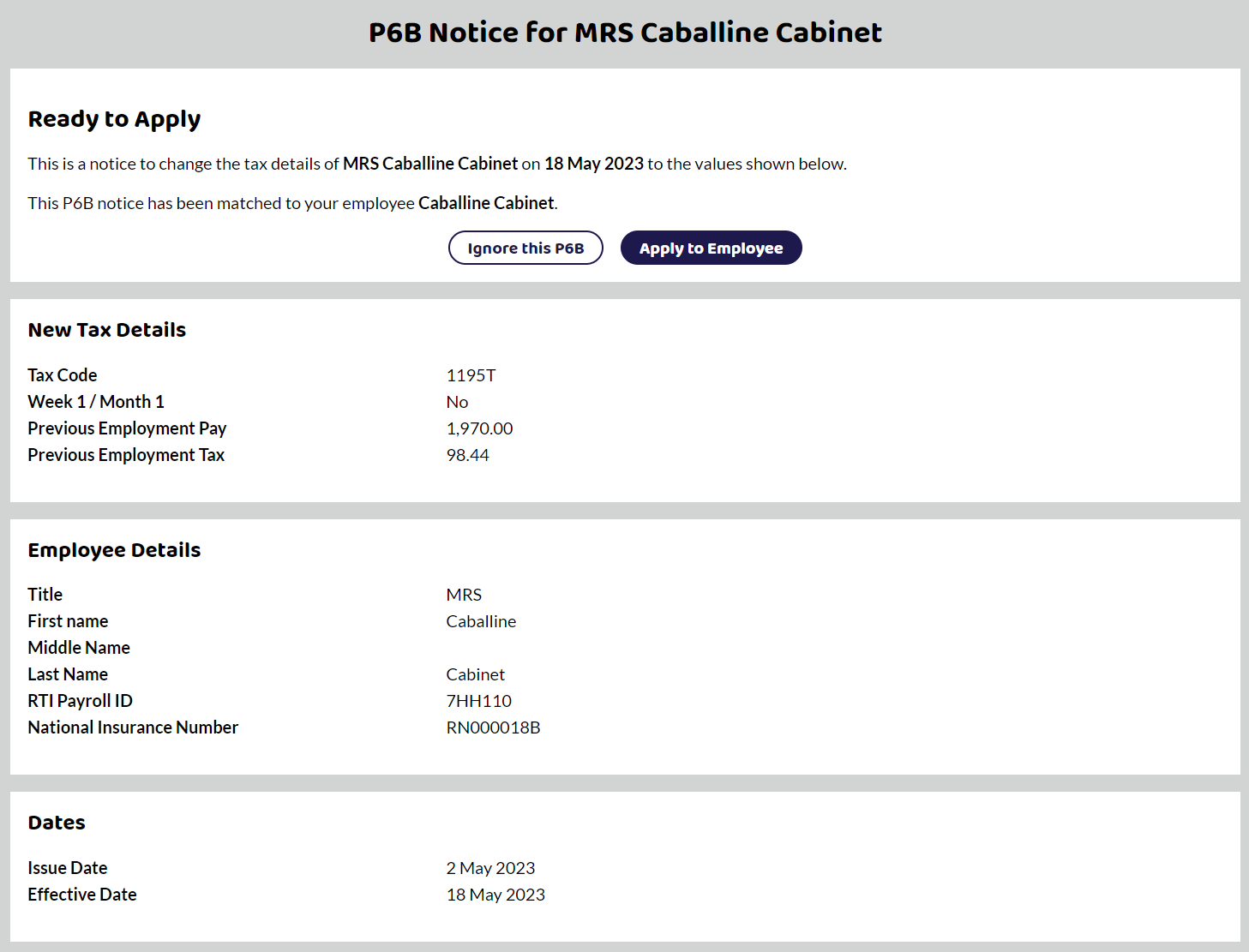

This notice has matched an employee.

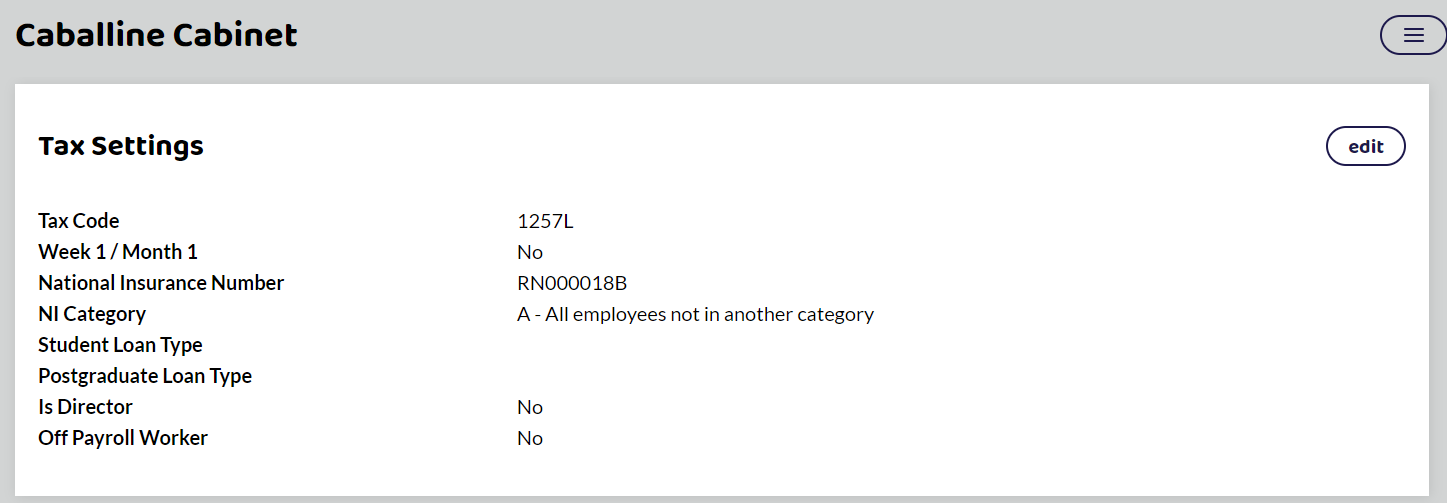

In the employee details screen, the employee is currently on a 1257L tax code and has no previous earnings.

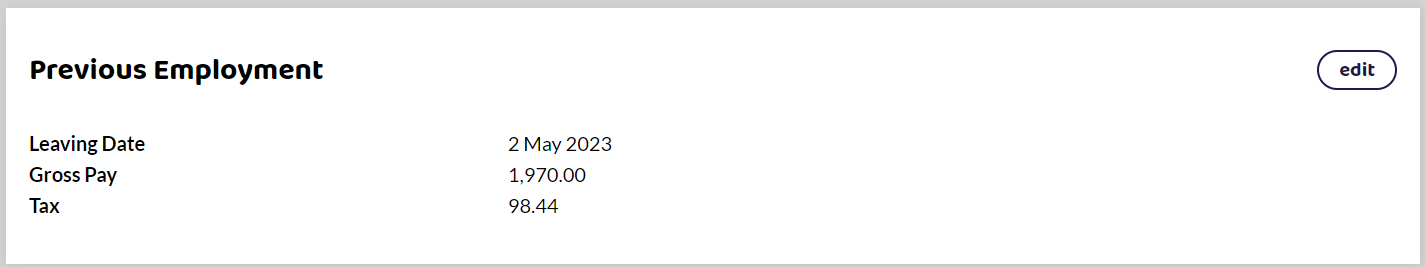

The tax code notice that has come through shows that the employee has had a tax code change and also that they have previous earnings in this tax year that needs to be applied. This is because HMRC want the employees previous earnings in the tax year to be taken into account when working out the employees future tax deductions.

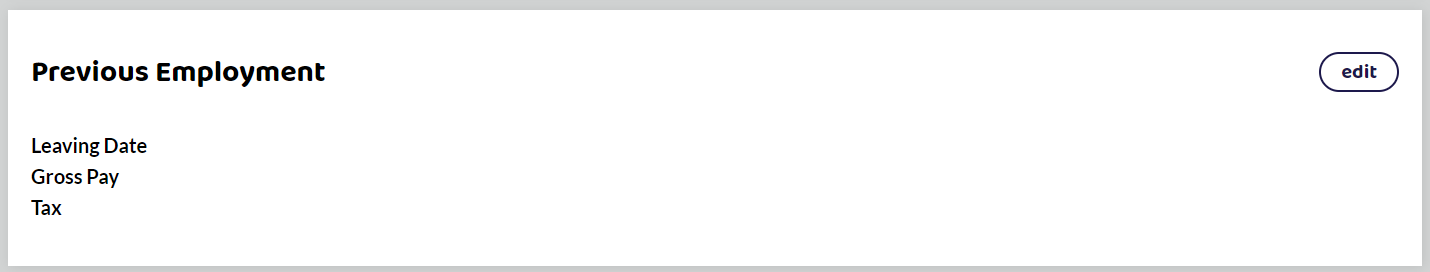

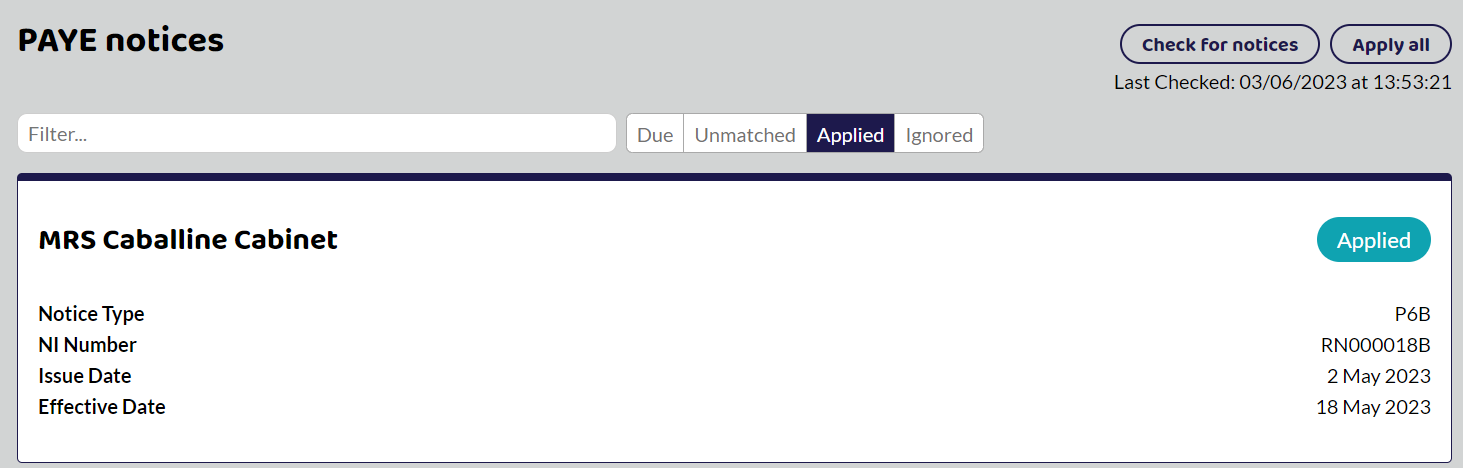

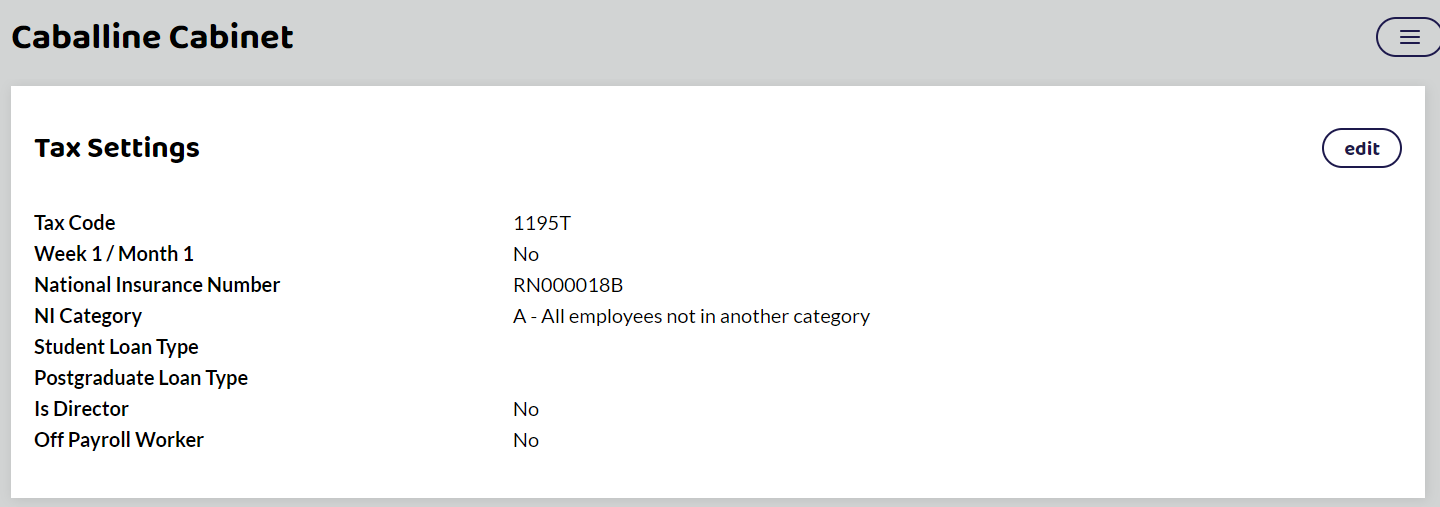

Once the tax code notice has been applied, the notice will disappear into the Applied group and the employees details have been updated.

The employees tax code has been updated to match the notice and the previous employment earnings have been added. From the next time to employee is paid, the new tax code and previous earnings will be taken into account.

Apply all Button

If there are a few notices and you are sure that they have matched the correct employees, then you can select the Apply all button in the top right hand corner.

It will not apply National Insurance Number changes to employees. This is because HMRC may have accidententally matched up the wrong employees details. These should always be checked first with the details held before updating the employee records.