You have completed your pay run and sent your FPS to HMRC but you want to correct the pay run. You want to tell HMRC before the next FPS is to be sent. Shape Payroll allows you to create and send an Additional FPS with the correction.

Only do this if you are sure that you need to make the correction. Sending lots of corrections to HMRC can cause errors within their system and may not always be accepted. Best practice is to triple check all payments and employee information before sending an FPS to HMRC. This is why Shape allows you to complete a pay run and you can first check all details including the payslips and reports before submitting the FPS to HMRC.

Early Years Updates have now been replaced by sending an additional FPS.

Edit the Pay Run

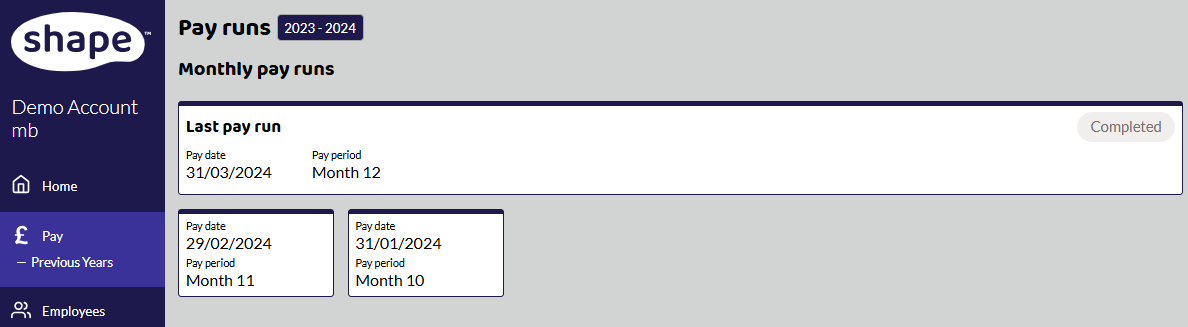

Select Pay in the side menu. If you have a current pay run this will shows as In Progress. Click the pay date you want to edit. Here we are editing the pay run 29 February 2024.

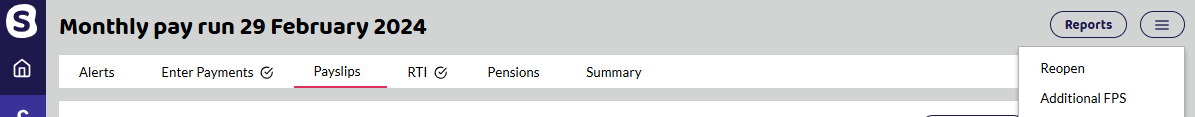

In the top-right-hand corner, click the blue button -> select Reopen.

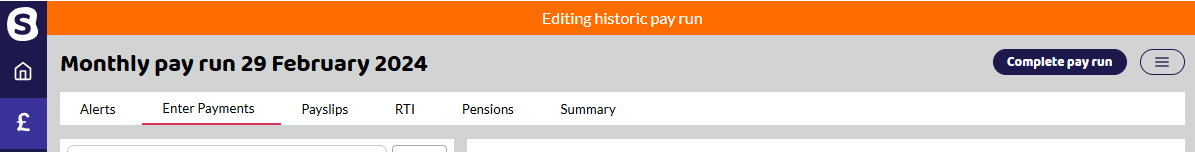

When you are editing an old pay run, you get an orange Editing historic pay run banner across the top. Make any adjustments you need to the employee's payments and then Complete Pay Run.

Create an Additional FPS

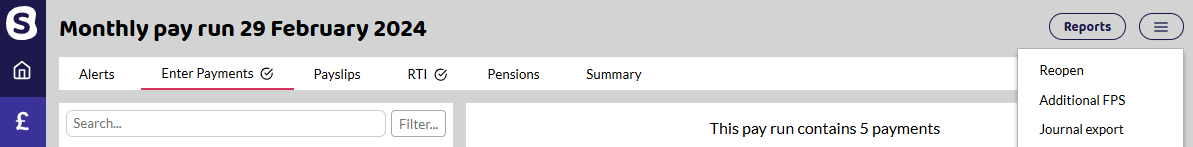

You are now ready to create an Additional FPS. Stay in the pay run you have just edited. In the top-right-hand corner, click the blue button -> select Additional FPS.

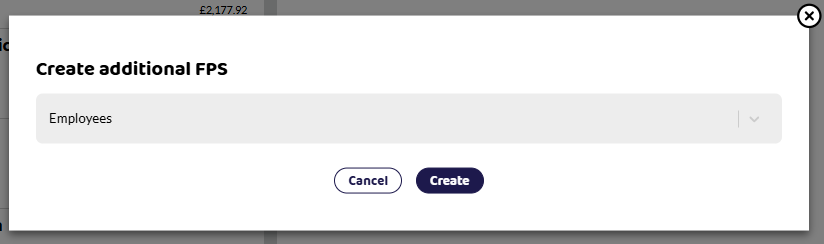

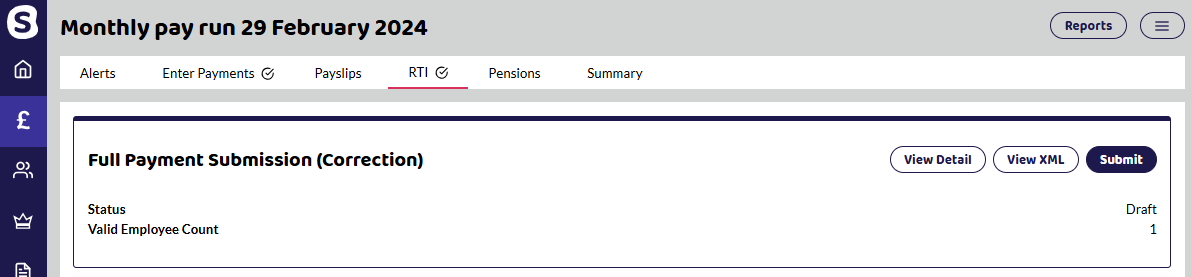

Select all the employees you want to create the correction for. You can view details first to make sure you are submitting the correct information. It shows how many employees are included in the submission. Until you submit it to HMRC, it shows as a draft.

If it is an FPS to correct a payment, it will show the difference between what was originally submitted and the correction FPS. See the example below.

Example - Updating an employee payment

You realise that you haven't paid Fred his overtime this month and you have agreed to pay him this pay run but you've already completed and sent HMRC the FPS. Shape Payroll gives you the option to reopen the pay run, make the required changes and let HMRC know.

You reopen the pay run and give Fred his £100 overtime payment. This increases his gross year to date figures to tax and NI by £100. You close the pay run, send Fred his updated pay slip, and create an additional FPS. When you view details of the FPS you will see that it is only sending the difference of £100 to HMRC and the correct year to date figures for gross pay, tax and NI.