Pension Assessment

There are 4 tags that will show in connection to pensions in the pay run. Shape assesses the employees when they are paid. New starters are postponed based on the pension settings. When they are first paid, and they are within the postponement period, they will have a Pension evaluation postponed tag.

Employees who are being assessed but do not meet the eligibility are tagged as Not eligible to join a pension.

Reasons for not being eligible can include being below the earnings threshold, under 22, or over state pension age.

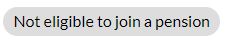

Employees who meet auto-enrolment will be tagged with Should be enrolled in a pension.

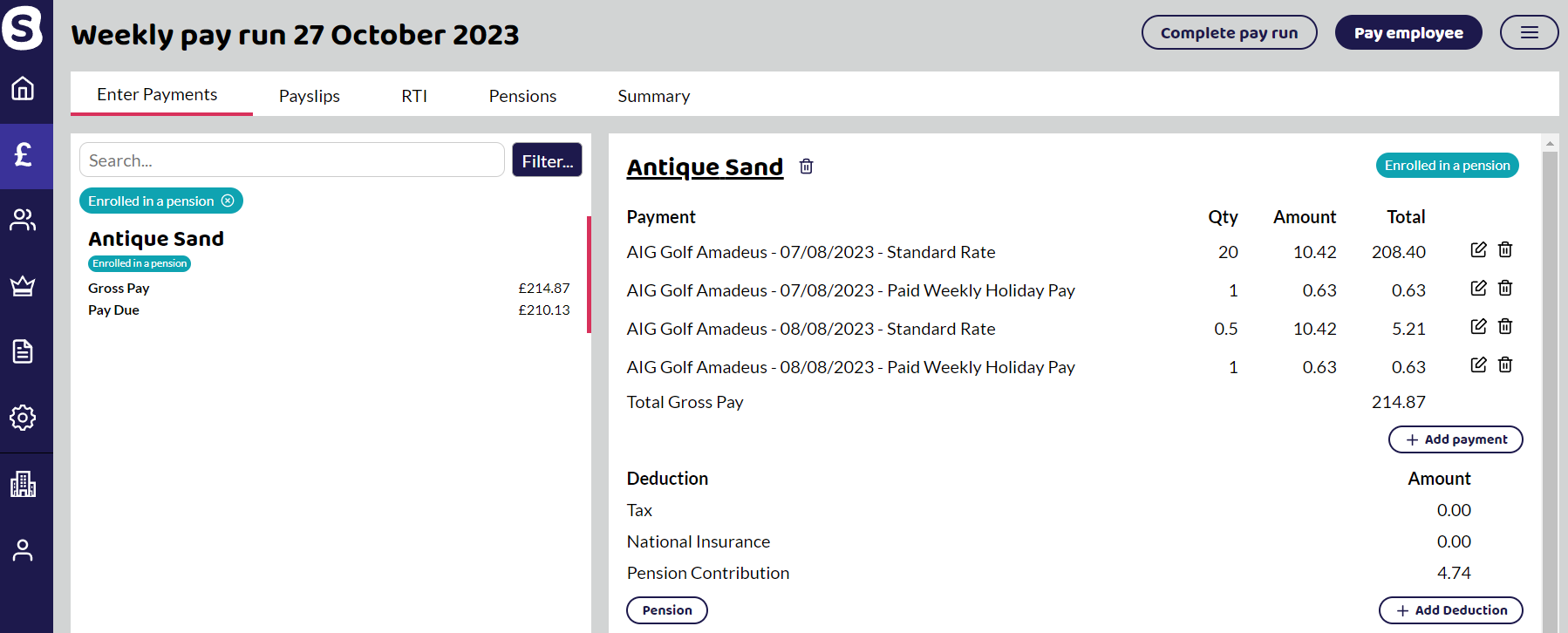

You can filter the employees in the pay run to see the pension state of the employees you want to review.

Enrol in Pension

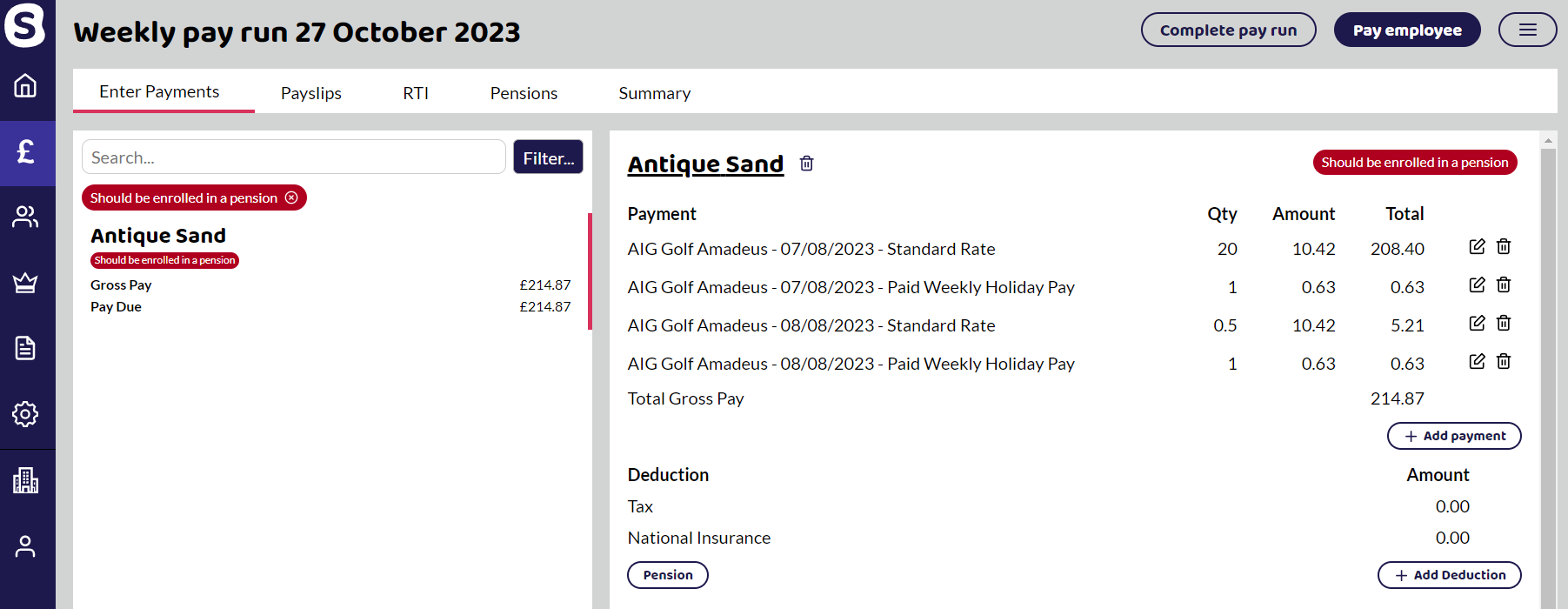

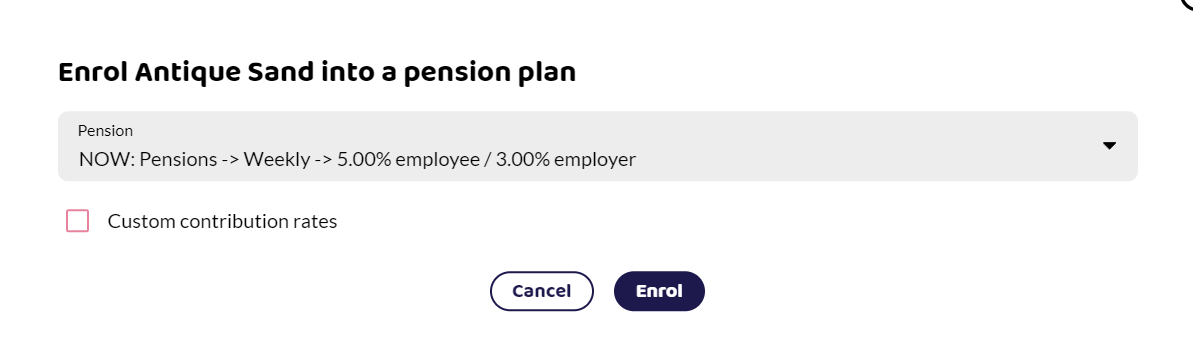

Select the employee and under the deduction section, select the Pension button.

You can see the only option is Enrol. Select this and if you have set up your pension groups under Pension Settings - you will be able to select a pension scheme.

Custom Contribution rates - only select this when an employee wants to make a different contribution – for example, they may wish to increase their contribution above 5%.

The employee is now enrolled into the pension scheme and will be included in the pension file contributions. The employee tag will update to Enrolled.