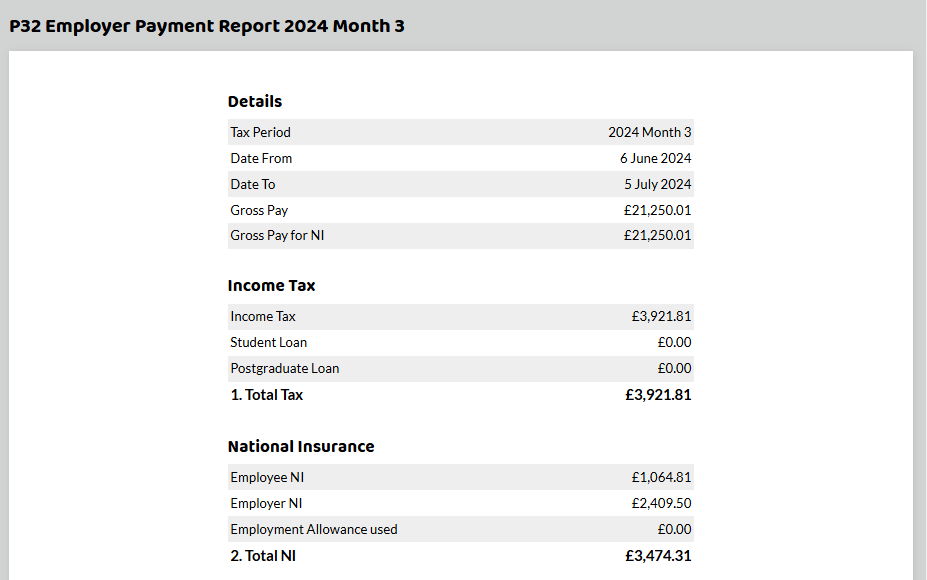

A P32 is the Employer Payment Report and is a summary of the payments you need to make to HMRC. This can include tax and national insurance deducted from employees, employer's national insurance, apprenticeship levy, any CIS suffered (if applicable) and any credits applied if you are eligible for the employment allowance.

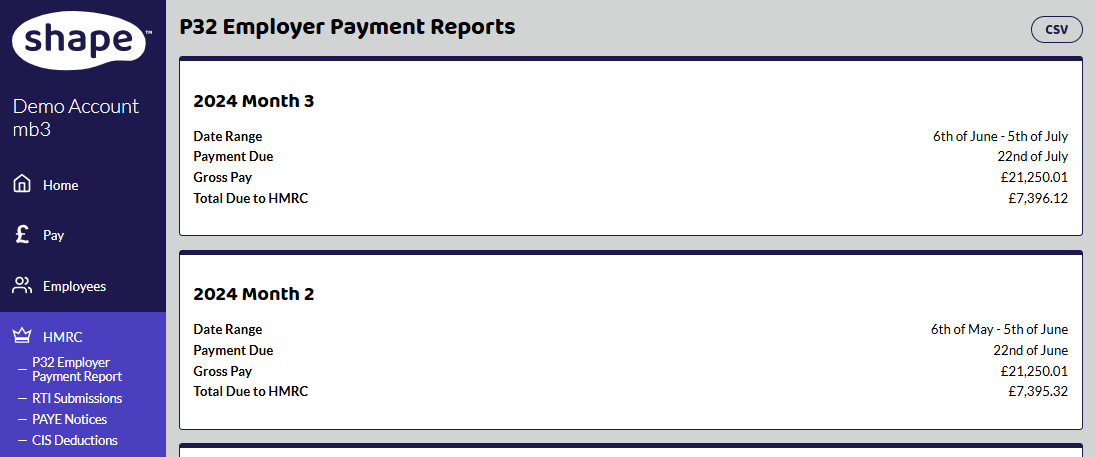

The P32 can be found under HMRC -> P32 Employer Payment Report. It is a summary of the tax month 6th - 5th of the following month. All pay runs within this month get added together and at the end of the tax month, you will see the total amount that is needed to be paid to HMRC.

You can also download a CSV file of all the reports.

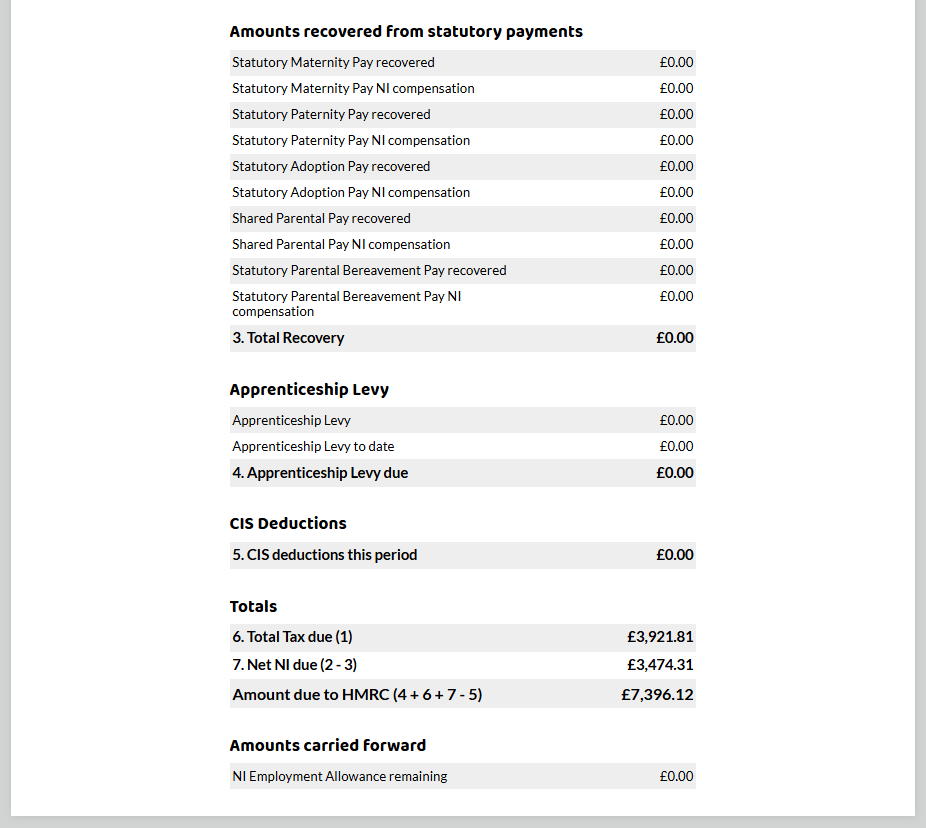

Any statutory payments that have been paid and recovered are shown in this report. You must send an Employer Payment Summary (EPS) to HMRC to make sure they apply the recovered amount to your account. An EPS will be automatically generated.

The Apprenticeship Levy, which some employers need to pay, is included in the P32 report.

You can also record CIS deductions and they will appear in your PAYE Liability screen enabling you to see your overall balance with HMRC.

Once you have made a payment to HMRC, you can record this in your PAYE Liability.

You should regularly check your government gateway account to make sure HMRC have allocated your payments correctly.

Find out more on how to Pay HMRC.