Automatic enrolment thresholds stay the same

For the first time since auto-enrolment was introduced, the earning thresholds for auto-enrolment have not increased in line with the national insurance contributions lower earnings limit.

The £10,000 earnings trigger has also not increased again this year and has been the same since the 2014-2015 tax year.

For 2021-2022, the national insurance contributions lower earnings limit was £120 and has risen to £123 for the 2022-23 tax year but the lower earnings threshold for auto-enrolment has stayed at £120. The reasoning behind not raising the thresholds is that it means more employees will be subject to paying into a pension scheme.

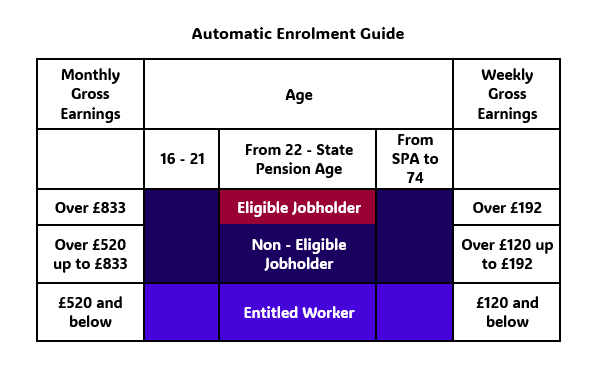

Read our help article on automatic enrolment here: Automatic Enrolment Guide

You can read the full review and the reasons for not raising the thresholds here: